Nordnet is a Swedish investment firm that offers a variety of trading services to customers in Sweden, Norway, Finland, Denmark, and Iceland. However, there have been some concerns raised about whether Nordnet is a legitimate broker or a scam.

In this article, we will take a closer look at Nordnet’s business practices and regulatory status to determine whether it is a safe and reliable broker.

Company Overview

Nordnet was founded in 1996 and is headquartered in Stockholm, Sweden. The company has over 2 million customers and is one of the largest investment firms in the Nordic region.

Nordnet offers a variety of trading services, including stocks, bonds, ETFs, mutual funds, and CFDs. The company also offers a variety of investment products, such as savings accounts, retirement plans, and insurance.

Team

Nordnet’s team is made up of experienced financial professionals with a proven track record of success. The company’s CEO is Martin Lorentzon, who is a serial entrepreneur and co-founder of Spotify.

Services or Products

Nordnet offers a wide range of trading services and products, including:

- Stocks: Nordnet offers trading in over 30,000 stocks from around the world.

- Bonds: Nordnet offers trading in bonds from a variety of countries and issuers.

- ETFs: Nordnet offers trading in over 1,000 ETFs from around the world.

- Mutual funds: Nordnet offers trading in over 10,000 mutual funds from around the world.

- CFDs: Nordnet offers trading in CFDs on a variety of assets, including stocks, commodities, and currencies.

- Savings accounts: Nordnet offers a variety of savings accounts with competitive interest rates.

- Retirement plans: Nordnet offers a variety of retirement plans, including individual retirement accounts (IRAs) and 401(k) plans.

- Insurance: Nordnet offers a variety of insurance products, such as life insurance, health insurance, and car insurance.

License and Regulations

Nordnet is regulated by the Financial Supervisory Authority of Sweden (Finansinspektionen). The company is also authorized to operate in Norway, Finland, Denmark, and Iceland.

License Status

Nordnet is licensed by the Financial Supervisory Authority of Sweden (Finansinspektionen) to provide investment services to customers in Sweden. The company is also authorized to operate in Norway, Finland, Denmark, and Iceland.

Regulation Status

Nordnet is regulated by the Financial Supervisory Authority of Sweden (Finansinspektionen) and the European Securities and Markets Authority (ESMA). The company is also subject to the laws and regulations of the countries in which it operates.

Why Dealing With An Unlicensed Broker Is Risky?

There are a number of risks associated with dealing with an unlicensed broker. These risks include:

- The broker may not be properly registered or regulated.

- The broker may not have the necessary financial resources to meet its obligations to its customers.

- The broker may engage in fraudulent or unethical practices.

- The customer may have difficulty recovering their funds if the broker goes bankrupt or disappears.

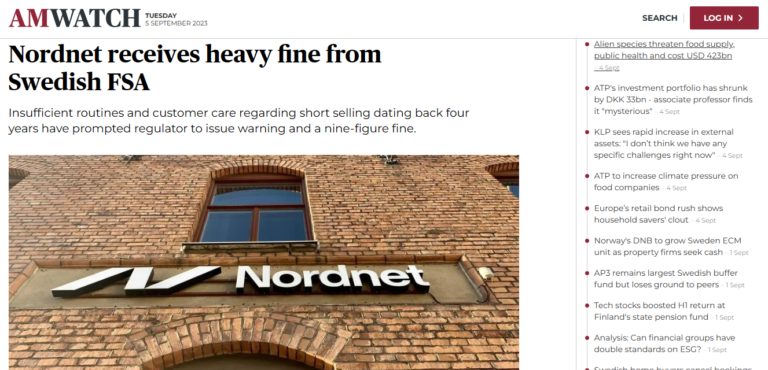

Legal Warning Against Nordnet

The Financial Supervisory Authority of Sweden (Finansinspektionen) has issued a legal warning against Nordnet for misleading its customers about the risks of trading CFDs. The warning states that Nordnet has been advertising CFDs as a “low-risk” investment, when in fact they are a high-risk product.

You also can go through our other scammer lists such as the SEC Blacklisted Companies, FCA Unauthorised Firms List, ASIC Blacklisted Companies, & Bank Guarantee/SBLC Review.

Client Feedback

There are a number of customer reviews of Nordnet available online. The reviews are mixed, with some customers reporting positive experiences and others reporting negative experiences.

Feedback About Their Customer Service

The feedback about Nordnet’s customer service is also mixed. Some customers report that the customer service is responsive and helpful, while others report that it can be slow to respond and that the representatives are not always knowledgeable.

How Can “Reviews Advice” Help You If You Get Scammed?

If you have been scammed by a broker, there are a few things you can do. First, you should contact your bank or credit card company and dispute the charges. You should also file a complaint with the Financial Industry Regulatory Authority (FINRA) or the Securities and Exchange Commission (SEC).

Our website can help you in regrading the recovery of your lost funds too. Our experts will provide you with some recovery service recommendations and professional guidance that will show you the options of how to recover the funds quickly.

Final Thought

If you think you have been scammed by a broker, you should contact your bank or credit card company immediately. You should also file a complaint with the appropriate regulatory agency.