In369 positions itself as a Swiss forex broker, yet it lacks the essential credentials and regulatory oversight to support this claim. Key indicators pointing to its dubious nature include:

- Absence of a valid forex license: This is a critical red flag, as regulated brokers are subject to stringent financial and operational standards.

- Regulatory warnings: The Financial Conduct Authority (FCA) and the Swiss Financial Market Supervisory Authority (FINMA) have issued warnings against In369, highlighting its unauthorized status.

These factors strongly suggest that In369 is not a legitimate broker and poses significant risks to traders’ funds.

Company Overview

Feature | In369 |

Regulation | Unregulated, no valid forex license |

Minimum Deposit | Not specified |

Payment Methods | Credit/Debit cards, Wire transfers |

Trading Platforms | Web-based platform with TradingView charts |

Trading Instruments | Forex, Commodities, Indices, Cryptocurrencies, Stocks |

Leverage | Not specified |

Services or Products

In369 claims to offer a wide range of trading instruments, including forex, commodities, indices, cryptocurrencies, and stocks. However, the lack of a reliable trading platform and transparent trading conditions raises serious concerns about the actual services provided.

If you have lost money to companies like MaxVol; or Plutus Capital; please report it to us on our report a scam form.

Trading Platform & Leverages

In369’s trading platform is solely based on TradingView charts, which does not facilitate actual trading. This is a major drawback compared to reputable brokers that offer advanced platforms like MetaTrader 4 and 5. Moreover, the broker fails to disclose leverage levels, which is another red flag.

Spreads and Cost of Trading

While In369 advertises tight spreads, actual calculations reveal average spreads of 1.1 pips for EURUSD, 1.4 pips for GBPUSD, and 1.2 pips for USDJPY. Although not exceptionally wide, these spreads are in line with industry standards. However, it’s important to consider that hidden fees or other unfavorable trading conditions might offset any potential benefits of tight spreads.

License and Regulations

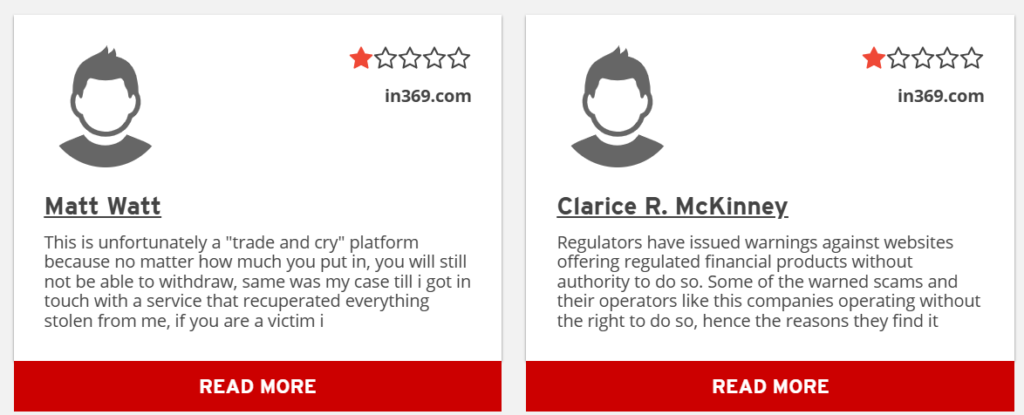

The most significant issue with In369 is its lack of regulatory oversight. The FCA and FINMA have issued warnings against the broker, categorizing it as unauthorized. This means In369 operates outside the legal framework, leaving traders unprotected in case of disputes or losses.

Legal Warning Against In369

Both the FCA and FINMA have explicitly warned investors about In369. These warnings underscore the broker’s illegal activities and the associated risks for those who engage with it.

Deposit and Withdrawal Methods

In369 offers credit/debit card and wire transfer options for deposits and withdrawals. While these methods are common, the broker imposes fees on credit/debit card withdrawals. It’s crucial to note that the absence of transparent withdrawal policies and potential difficulties in recovering funds are common characteristics of scam brokers.

In369 Pros and Cons

Pros | Cons |

None | No legitimate forex license |

Falsely claims registration in Switzerland | |

FINMA warning | |

No reliable trading software | |

Non-transparent trading conditions |

Why Dealing With An Unlicensed Broker Is Risky?

Trading with an unlicensed broker exposes you to numerous risks, including:

- Loss of funds: There is no guarantee that your funds are safe with an unregulated broker.

- Lack of protection: You have no legal recourse if something goes wrong.

- Market manipulation: Unlicensed brokers may engage in fraudulent practices.

- Data privacy concerns: Your personal and financial information may be compromised.

Client Feedback

Unfortunately, there is limited reliable information available regarding client experiences with In369. However, the absence of positive reviews and the prevailing regulatory warnings should raise significant concerns.

How Can “Reviewsadvice” Help You If You Get Scammed?

If you believe you have been scammed by In369 or any other broker, seeking professional help is crucial. “Reviewsadvice” can provide guidance on:

- Understanding your legal options

- Recovering lost funds

- Reporting the scam to relevant authorities

You can report to us today using the form below.

File A Complaint Against Scammers

Final Thought

In conclusion, In369 presents itself as a deceptive entity with no legitimate standing in the forex market. The absence of a license, regulatory warnings, and lack of transparency are clear indicators of a potential scam. Protecting your hard-earned money should be a top priority, and dealing with unregulated brokers like In369 poses unnecessary risks. Always conduct thorough research and prioritize regulated brokers when choosing a trading platform.