Key points indicating ICE FX as a potential scam:

- Limited Regulation: Only regulated by the Labuan Financial Services Authority, which is a less stringent regulatory body compared to tier-1 regulators like FCA or ASIC.

- High Leverage: Offering a maximum leverage of 1:500, which is extremely risky and often associated with unregulated brokers.

- Lack of Transparency: Information about the company, its ownership, and management team is scarce.

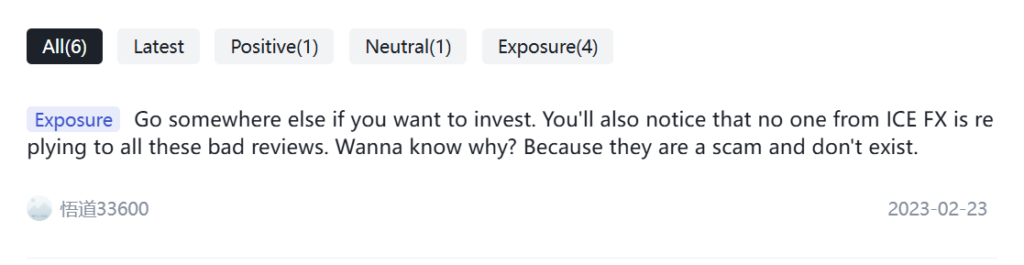

- Negative Reviews: Several online platforms have negative reviews about ICE FX, alleging issues with withdrawals, platform glitches, and poor customer support.

Company Overview

Feature | Details |

Broker’s Name | ICE FX |

Headquartered | Malaysia |

Year Founded | 2015 |

Regulating Authorities | Only FSAC |

Countries not accepted for trade | Malaysia, US |

Islamic account (swap-free) | Not indicated |

Demo Account | Yes |

Institutional Accounts | Not indicated |

Managed Accounts | Not indicated |

Maximum Leverage | 1:500 |

Minimum Deposit | $50 |

Deposit Options | Bank Wire, CoinGate, Neteller, Skrill, WebMoney |

Withdrawal Options | Bank Wire, CoinGate, Neteller, Skrill, WebMoney |

Platform Types | MT4 |

OS Compatibility | Mac, Windows, Linux, Web, Mobile Android, iPhone, iPad |

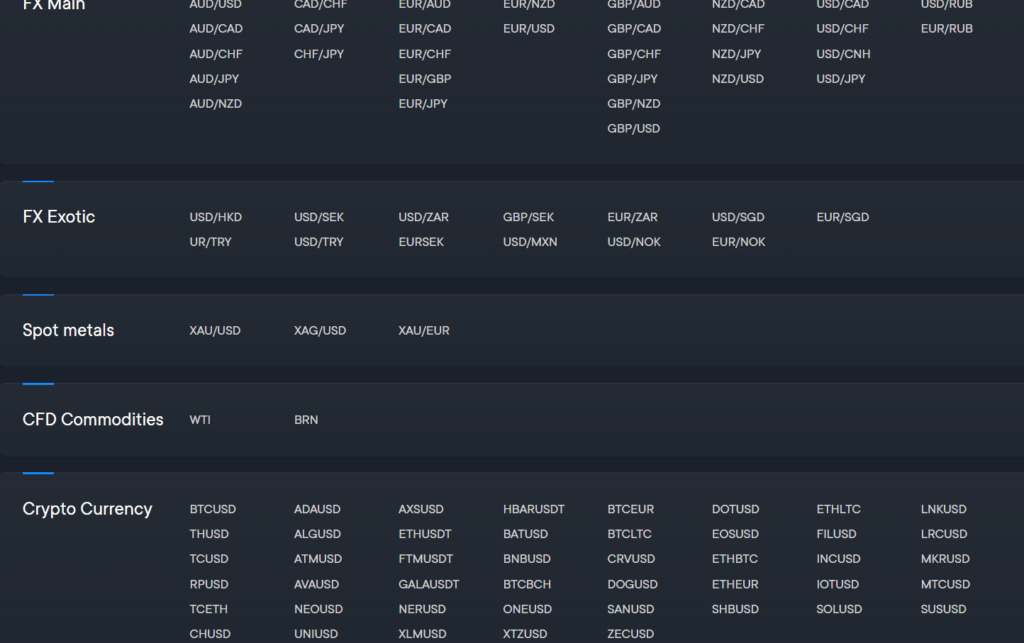

Tradable assets offered | Currencies, Cryptocurrencies, CFDs (Gold, Silver, Other Precious Metals, Stock Indexes, Oil, Other Commodities) |

Languages supported | English, Russian |

Customer Support Languages | English, Russian, Spanish |

Customer Service Hours | 24 hours per day, 5 days per week |

Services or Products

ICE FX primarily offers online trading services in forex, cryptocurrencies, commodities, indices, and precious metals. It operates through the MT4 trading platform and provides various account types, including STP, STP-MA, and demo accounts.

If you have lost money to companies like Monetari Fund; or Coindex; please report it to us on our report a scam form.

Trading Platform & Leverages

ICE FX utilizes the popular MT4 trading platform, which offers a user-friendly interface and essential trading tools. However, the broker’s decision to offer extremely high leverage of up to 1:500 is a red flag. Such high leverage significantly increases the risk of substantial losses and is often a characteristic of unregulated brokers.

Spreads and Cost of Trading

ICE FX claims to offer competitive spreads across its range of tradable assets, which includes forex pairs, precious metals, commodities, and cryptocurrencies. It’s essential to note that spreads can fluctuate based on market conditions, volatility, and liquidity.

In addition to spreads, ICE FX charges commissions on each executed trade. The commission rate varies depending on the specific trading instrument and account type.

- STP Account: Commissions on this account type range from 0.0025% to 0.25% of the trade value.

- STP-MA Account: Designed for managed accounts, this account type also incurs commissions, with rates falling between 0.004% and 0.006% of the trade value.

License and Regulations

ICE FX is registered with the Labuan Financial Services Authority (FSA), a regulatory body with a less stringent reputation compared to tier-1 regulators. It’s crucial to note that the Labuan FSA is not recognized as a top-tier financial regulator, raising concerns about the broker’s reliability and investor protection.

Legal Warning Against ICE FX

While no explicit legal warning against ICE FX was found, the lack of stringent regulation and the presence of negative reviews online should raise red flags. It’s advisable to conduct thorough research and exercise caution before considering trading with ICE FX.

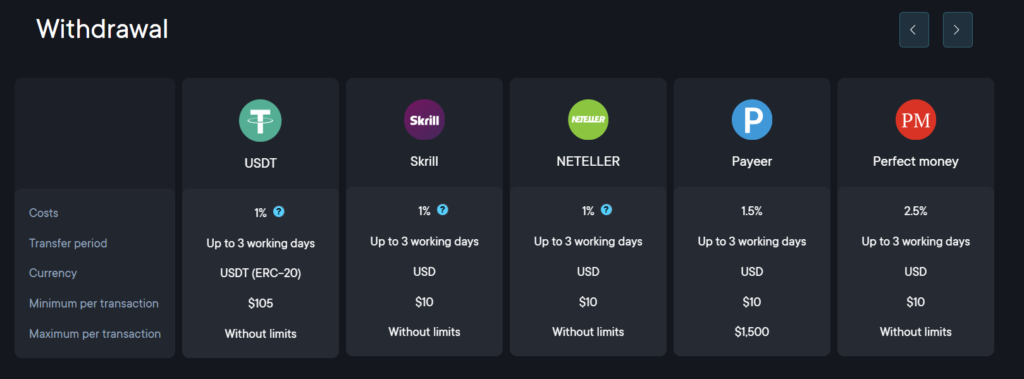

Deposit and Withdrawal Methods

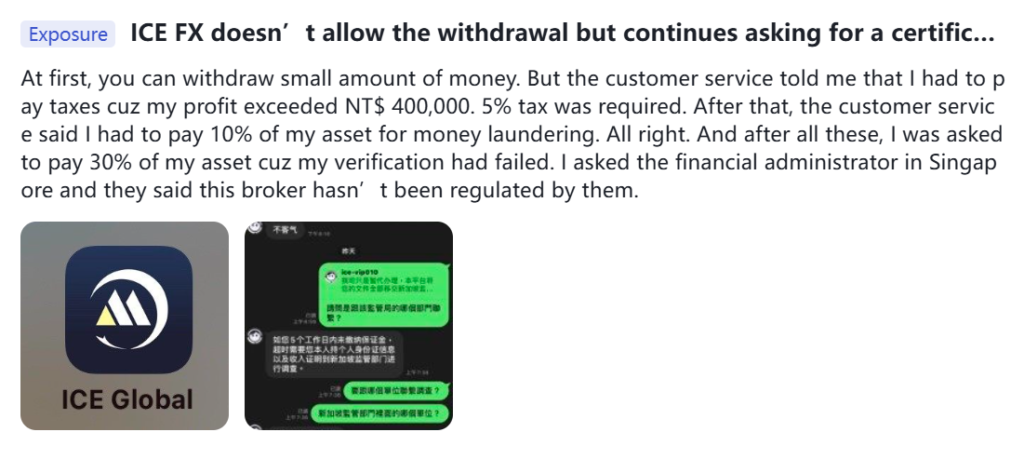

ICE FX offers various deposit and withdrawal methods, including bank wire, e-wallets, and cryptocurrencies. However, numerous complaints about withdrawal delays and difficulties have surfaced online, indicating potential issues with fund accessibility.

ICE FX Pros and Cons

Pros | Cons |

Offers MT4 platform | Limited regulation |

Variety of trading instruments | High leverage (risky) |

Demo account available | Negative online reviews |

Multiple deposit/withdrawal methods | Potential withdrawal issues |

Why Dealing With An Unlicensed Broker Is Risky?

Dealing with an unlicensed broker like ICE FX exposes traders to significant risks:

- Lack of investor protection: Traders have limited recourse in case of disputes or fraud.

- Higher risk of scams: Unregulated brokers are more likely to engage in fraudulent activities.

- Limited transparency: Financial information and operations may not be disclosed.

- Difficulty in recovering funds: Withdrawing funds can be challenging or impossible.

Client Feedback

Online reviews about ICE FX are predominantly negative, with traders reporting issues such as difficulty withdrawing funds, platform glitches, and unresponsive customer support. These experiences further reinforce the concerns about the broker’s reliability.

How Can “Reviews Advice” Help You If You Get Scammed?

“Reviewsadvice” can assist scam victims by providing information about recovery options, legal guidance, and support. They can help you understand the steps involved in recovering lost funds and connect you with professionals who specialize in fraud recovery or you can report to us today by the below form.

File A Complaint Against Scammers

Final Thought

ICE FX’s limited regulation, high leverage, and negative online reputation raise significant concerns about its legitimacy as a broker. Traders should prioritize safety and choose regulated brokers with a proven track record. It’s essential to conduct thorough research and consider the risks involved before investing with any broker.