Is First Invest Capital Legit or Scam?

Trading online provides exciting opportunities, but it also carries inherent risks. Unfortunately, unscrupulous brokers can exploit these risks, turning dreams into nightmares. First Invest Capital is one such name to avoid, and this review details the red flags that expose its true nature.

Company Overview

Broker status: | Unregulated |

Regulated by: | No regulations |

Operating Status: | Active trading scam |

Known Websites: | |

Blacklisted by: | BaFin |

Owner: | N/A |

Headquarters Country: | N/A |

Foundation Year: | 2023 |

Online Trading Platforms: | Web trader |

Mobile Trading: | Not available |

Minimum Deposit: | 12.500 EUR |

Deposit Bonus: | No |

CFD Trading Option: | Yes |

Crypto Asset Trading: | Yes – BTC, ETH, LTC |

Available Trading Instruments: | Cryptocurrencies, Forex, Indices, Commodities, Shares |

Maximum Leverage: | 1:400 |

Islamic Account: | Not available |

Free Demo Account: | Not available |

Accepts US clients: | US clients are accepted |

Our professionals’ Verdict: | With the ongoing investigation from German BaFin, you know there are troubles with this broker. Therefore, we suggest you withdraw all of your funds. Yet, you can expect issues and if you experience any contact our refund team for advice. |

Services or Products

First Invest Capital offers a limited range of CFDs on various assets, including:

- Forex: Major and minor currency pairs

- Commodities: Gold, silver, etc.

- Indices: DAX30, FTSE100, etc.

- Shares: Tesla, Apple, etc.

- Cryptocurrencies: Bitcoin, Ethereum, Litecoin

However, be wary of these offerings, as hidden fees and manipulative practices may await.

If you have lost money to companies like 72FXOptMetaTrade, or DeCapitals; please report it to us on our Report a Scam form.

Trading Platform & Leverages

The broker claims to offer the MT4 platform, but in reality, it provides a basic web trader with limited functionalities. This raises concerns about transparency and lack of access to industry-standard tools. Additionally, the high leverage of up to 1:400 is incredibly risky for inexperienced traders and goes against responsible brokerage practices.

Spreads and Cost of Trading

First Invest Capital’s spreads and costs are unclear. The advertised 2.8 pips spread without commissions sounds attractive, but hidden fees and manipulative practices are likely present. Remember, if something seems too good to be true, it probably is.

License and Regulations

First Invest Capital operates without any regulatory oversight. This is a critical red flag indicating a lack of accountability and transparency. Legitimate brokers are licensed and regulated by reputable bodies like the Financial Conduct Authority (FCA), BaFin, or ASIC to ensure fairness and investor protection.

Legal Warning Against First Invest Capital

BaFin’s public warning against First Invest Capital serves as a strong reminder of the potential risks involved. This action by a trusted regulator highlights concerns about the broker’s activities and underscores the importance of dealing with licensed and regulated entities.

Deposit and Withdrawal Methods

First Invest Capital’s withdrawal policy is shady, with hidden minimum trading requirements for bonus users. This is a common tactic used by scam brokers to make withdrawals difficult or impossible. Additionally, the broker may push anonymous crypto transfers, further obscuring their activities and making tracing funds challenging.

First Invest Capital Pros and Cons

Pros | Cons |

None | Unregulated |

None | BaFin warning |

None | Negative reviews |

High minimum deposit | |

No demo account | |

Shady withdrawal policy | |

Potential for manipulation |

Why Dealing With An Unlicensed Broker Is Risky

Unlicensed brokers operate outside the law, putting your funds and personal information at risk. They are:

- Accountable to no one: You have no legal recourse if things go wrong.

- Prone to manipulation: Spreads, fees, and leverage can be manipulated to your disadvantage.

- Susceptible to scams: Exit scams, hidden charges, and fraudulent activities are common.

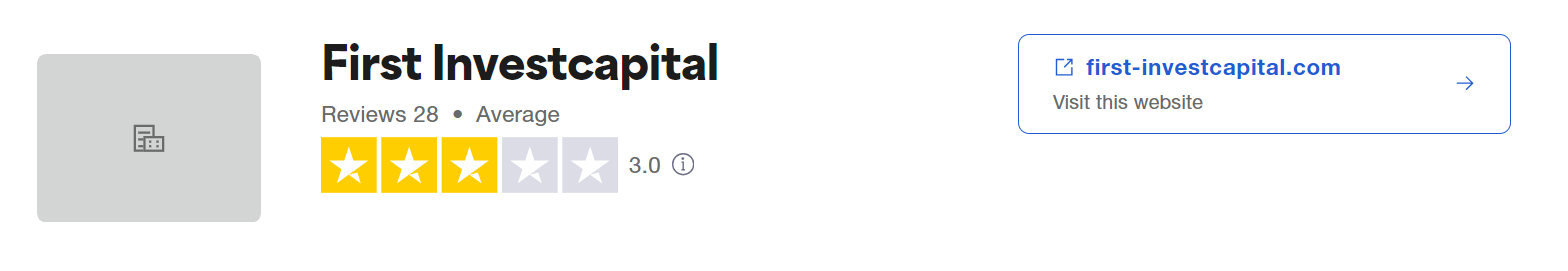

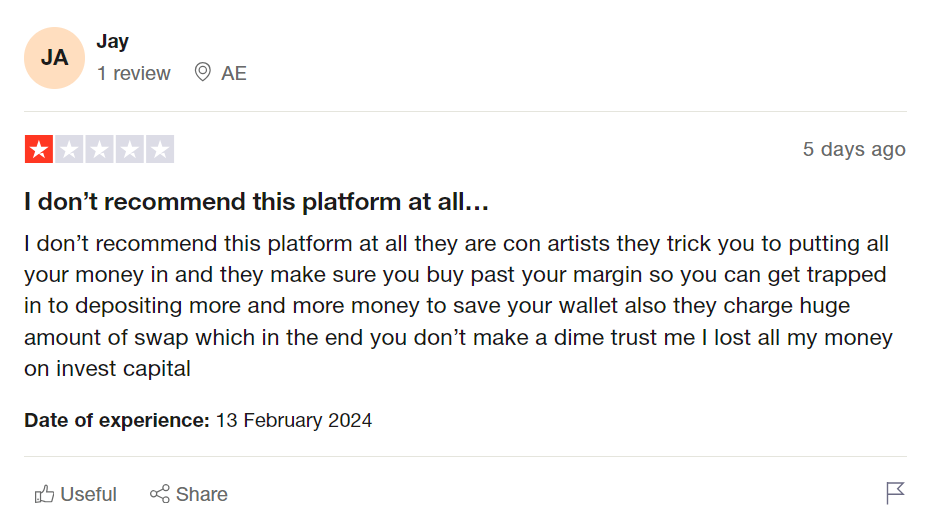

Client Feedback

Client experiences paint a grim picture. Trustpilot is dominated by negative reviews detailing withdrawal issues, deceptive practices, and unresponsive customer service. This consistent pattern of complaints reveals a concerning trend and highlights the potential dangers of using this broker.

How Can “Reviewsadvice” Help You If You Get Scammed?

If you’ve been scammed by First Invest Capital or any other unlicensed broker, seeking legal advice is crucial. Consider contacting financial regulators and reporting your experience. However, recovering lost funds can be challenging.

Our professional will provide you with a free consultation call to help in find the right guidance and recovery service solution or You Can report to us today by the below form.

File A Complaint Against Scammers

Final Thought

First Invest Capital is a clear example of a fraudulent broker. The lack of regulation, negative reviews, and shady practices should be enough to deter any potential investor. Remember, your safety and financial well-being are paramount. Choose a regulated and reputable broker to ensure a secure and transparent trading experience.