Is Wisevests Legit or Scam?

Spoiler alert: The evidence overwhelmingly points towards a scam. While the platform boasts user-friendly interfaces and enticing promises, red flags abound, raising serious concerns about its legitimacy and safety.

Company Overview: A Facade of Legitimacy?

Company type | Active offshore trading scam |

Legal name | GroupUp Green LLC |

Regulation | Unregulated |

Registered in | Saint Vincent and the Grenadines |

Established | 2023 |

Website | |

Financial Authorities Warnings | Yes – FMA, CBR, CONSOB, FSMA, ATV-P, Finanstilsynet |

Contacts | Phone; e-mail; web contact form |

If a withdrawal is possible | Highly unlikely |

Fees | Hidden fees |

If Active on Social Media: | No |

Investor Protection: | None |

Activity areas | Belgium, France, Austria, Switzerland, United Kingdom |

Main threats | Missing regulations; Numerous warnings and negative reviews; unclear conditions; |

Main perks | None |

Services or Products: Digging Deeper

The primary reason to be wary of these companies is their easy manipulation of fees, prices, and profits. In addition, trading circumstances like leverage have the potential to instantly deplete your balance. If we exclude it, though, instrument availability is really good. One may trade:

- Forex – EUR/SEK, AUD/NZD, USD/JPY

- Commodities – natural gas, crude oil, palladium

- Shares – American Airlines, Deutsche Bank, General Motors Company

- Cryptos – BTC, ETH, XRP

- Indices – ASX 200, DAX 30, CAC 40

Trading Platform & Leverages: A Foggy Landscape

It’s crucial to understand that reliable trading software does not equate to a reliable broker. However, selecting software is often quite important when picking a broker. Sadly, the trading platform offered by Wisevests is web-based and untrustworthy. These platforms provide developers with convenient access to the back end, enabling them to modify the information displayed. For example, balances, gains and losses, or anything else.

Nothing about their advertised advanced trading platform is advanced. We advise traders to utilize cTrader or MetaTrader instead. Naturally, with regulated businesses.

With Wisevests scam broker, the maximum leverage available is 1:200. If negative balance protection is not provided, this is definitely something you want to stay away from. As an illustration, consider this broker.

If you have lost money to companies like Inftrade, or Puprime; please report it to us on our report a scam form.

Spreads and Cost of Trading: Hidden Costs Await?

Wisevests remains opaque about its spreads and fees, crucial factors impacting profitability. This lack of clarity suggests potential hidden charges and manipulative practices.

License and Regulations: Unlicensed Operation, Unmitigated Risk

The absence of regulatory oversight is a major dealbreaker. Unlicensed brokers operate outside the law, exposing users to significant risks including:

- Fraudulent activities: No legal recourse if scammed.

- Fund mismanagement: No protection against misappropriated funds.

- Manipulative trading practices: No safeguard against unfair market manipulation.

Wisevests’ legal warning itself acknowledges potential “losses, risks, and damages,” further solidifying the inherent dangers involved.

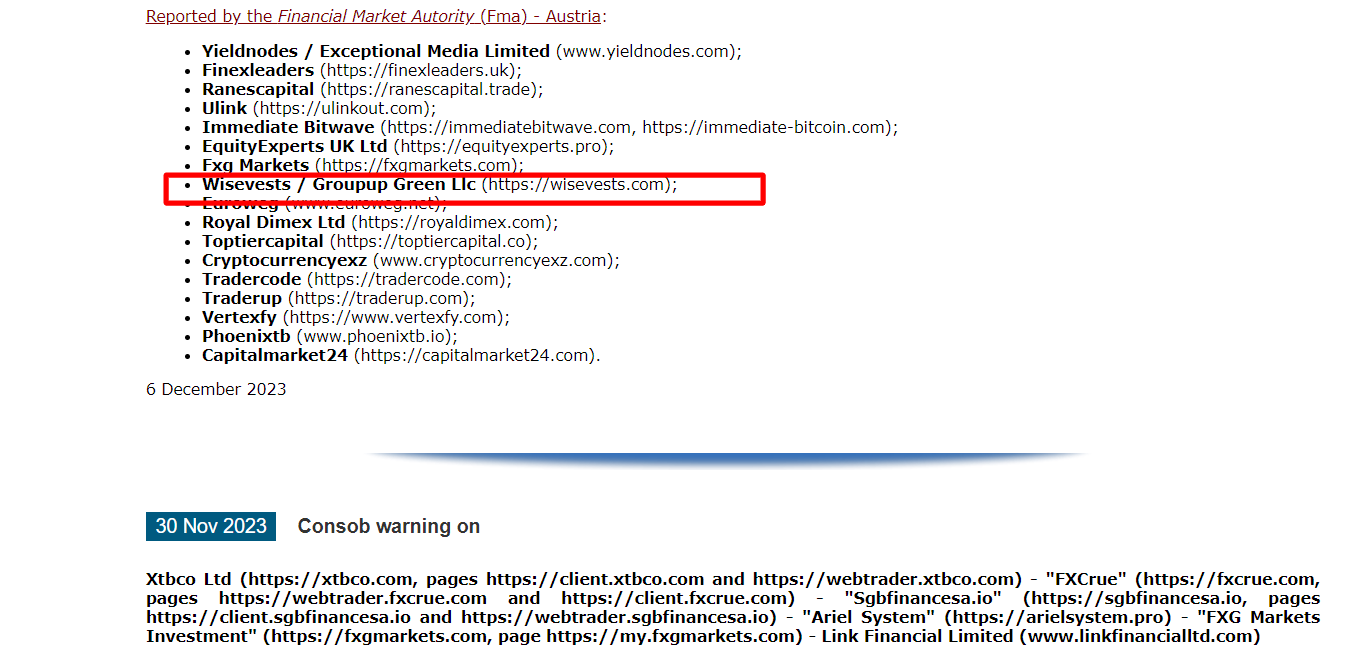

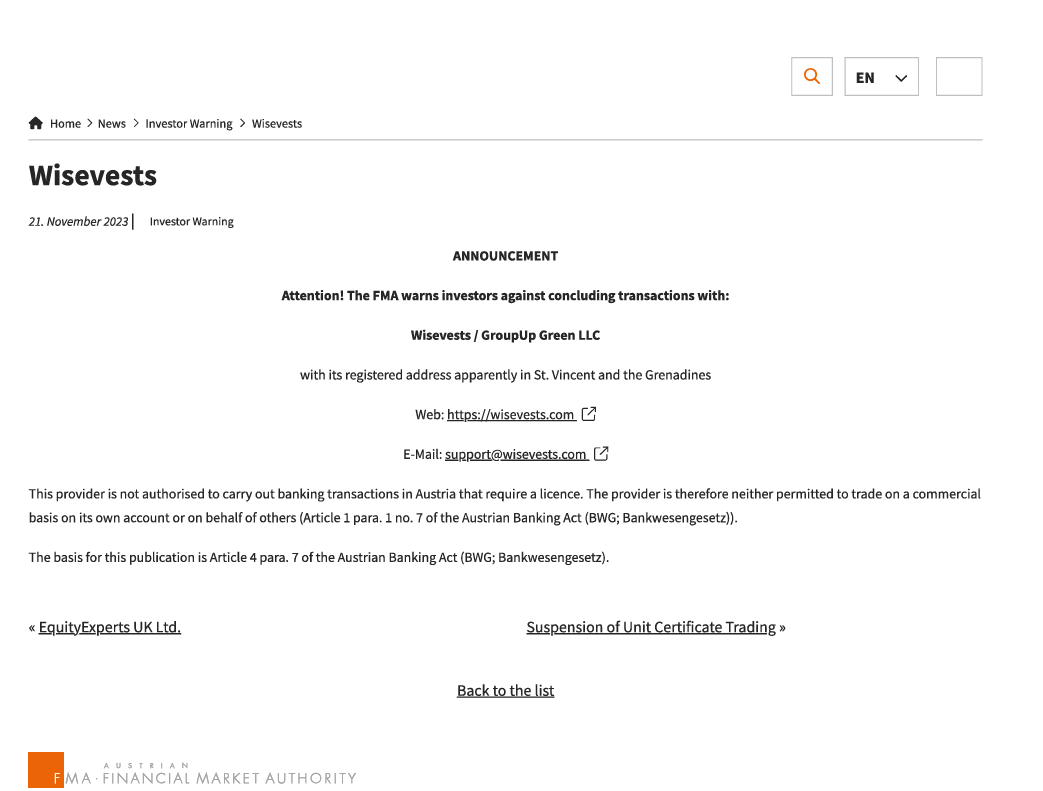

Legal Warnings Against Wisevests

Several warnings have been released by reliable regulatory bodies. There are many items on the list. Regardless, this broker’s confidence is sealed after these. ATV-P, FMA Austria, Finanstilsynet, CONSOB, FSMA, and the Russian Central Bank are among the organizations that issued a warning against them.

Deposit and Withdrawal Methods: Murky Waters

Definitely not, not after all the cautions, hints, and manipulations that have been mentioned. They wouldn’t be on as many warning lists if they weren’t. It’s noteworthy that the business doesn’t even disclose how it raises money. Not to mention the rules of withdrawals.

Wisevests Pros and Cons: A One-Sided Story

Pros | Cons |

User-friendly interface (reportedly) | Unlicensed operation |

Lack of transparency | |

High-risk potential |

Why Dealing With An Unlicensed Broker Is Risky?

Unlicensed brokers operate outside the watchful eye of financial authorities, exposing users to a multitude of risks, including:

- No guarantee of fund safety: Unregulated platforms can easily mismanage or misappropriate user funds.

- Manipulative trading practices: Unrestrained platforms can manipulate markets to their advantage, unfairly impacting user trades.

- Limited dispute resolution: Victims of fraud have limited legal recourse against unlicensed entities.

The potential consequences of dealing with an unlicensed broker are severe and far-reaching, making it a gamble no investor should take.

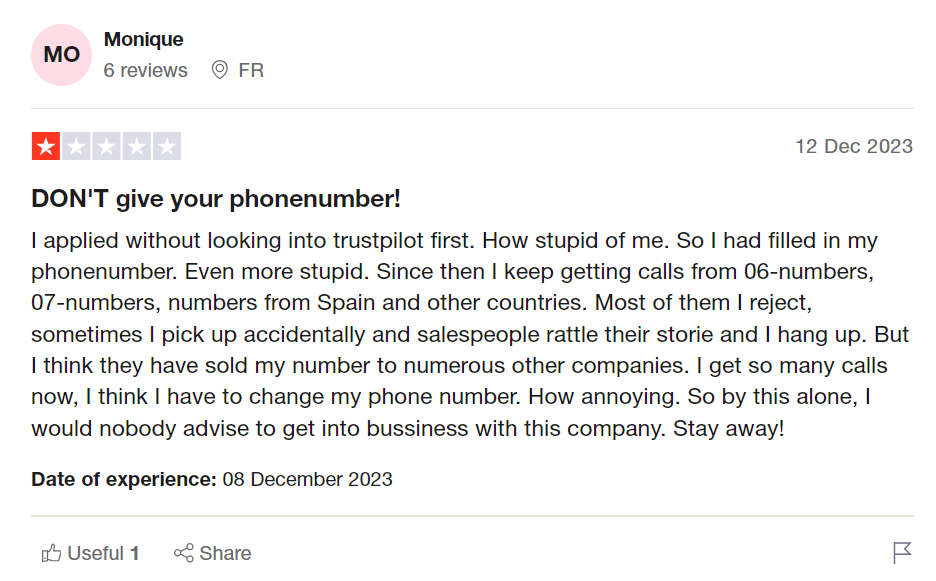

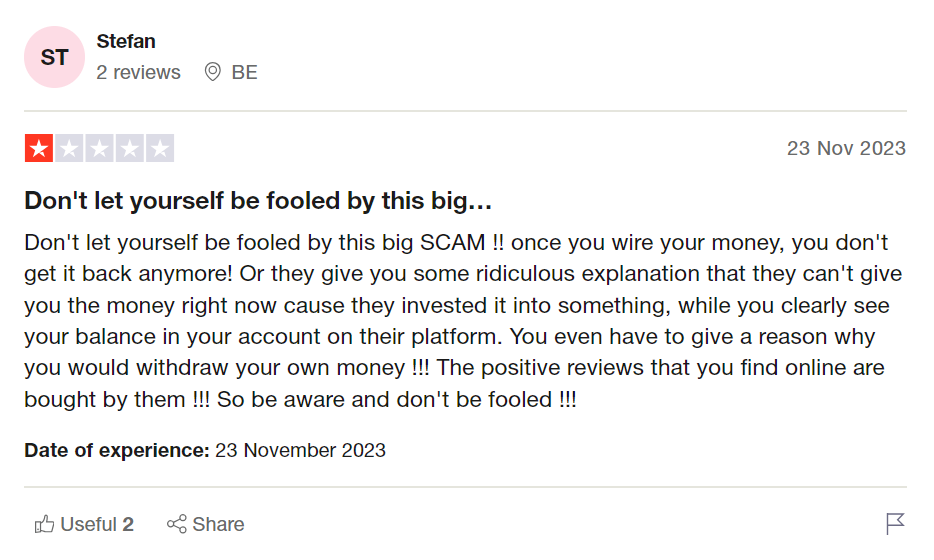

Client Feedback: A Chorus of Caution

Negative client reviews of Wisevests speak volumes. Users report difficulties withdrawing funds, unresponsive customer service, and suspected fraudulent activities. These firsthand accounts further substantiate the platform’s dubious nature.

How Can “Reviews Advice” Help You If You Get Scammed?

Unfortunately, seeking help after being scammed can be challenging. However, “ReviewsAdvice” aims to prevent scams by actively exposing fraudulent platforms and educating users about safe investing practices. Our free consultation can provide you with professional guidance and recovery service recommendations to help you recover the lost funds or you can report to us today by the below form.

Get Your Money Back from Scammers.

Final Thought: Steer Clear of Wisevests and Seek Legitimate Alternatives

The abundance of red flags around Wisevests leaves no room for doubt. Its unlicensed operation, lack of transparency, and negative client feedback paint a clear picture of a platform best avoided. If you’re seeking to explore the crypto world, prioritize regulated brokers with verifiable track records and transparent practices. Remember, safeguarding your hard-earned money is paramount – don’t be drawn in by false promises and potentially lose everything. Choose wisely, choose legally, and invest safely.