- Unregulated Platform: The biggest red flag is the lack of regulation. Without oversight from a reputable financial authority, there’s no guarantee of fair practices or investor protection.

- Short Establishment Period: Being a relatively new company raises concerns about experience and track record. Established brokers often have a proven history of reliability.

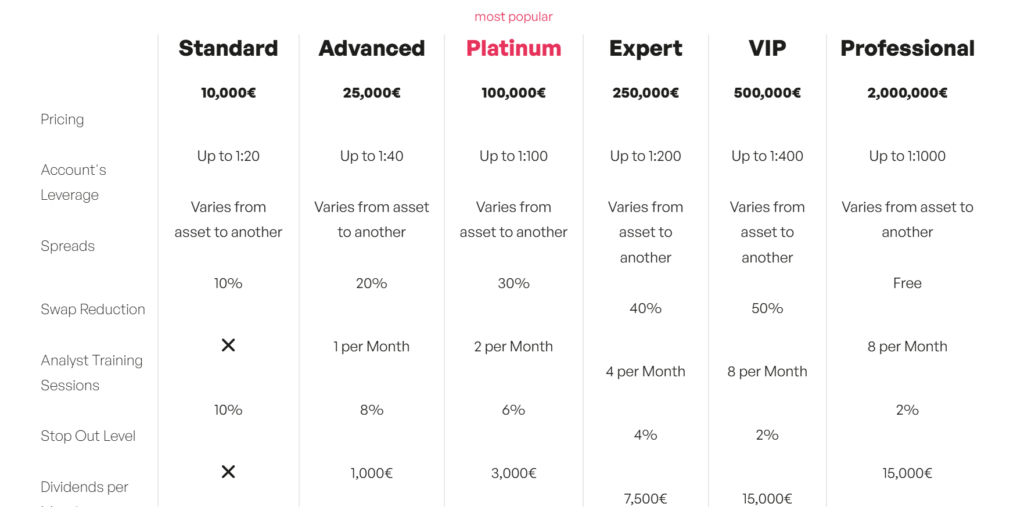

- High Minimum Deposit Requirements: Starting account sizes range from €10,000 to a staggering €2,000,000, potentially locking in new traders with significant financial risk.

- Unclear Spreads and Commissions: The review mentions tiered spreads and commissions, but without specific details, it’s difficult to assess true trading costs.

Company Overview

Aspect | Details |

Company Name | |

Registered Country/Area | Saint Vincent and the Grenadines |

Founded Year | Within 1 year |

Regulation | Unregulated |

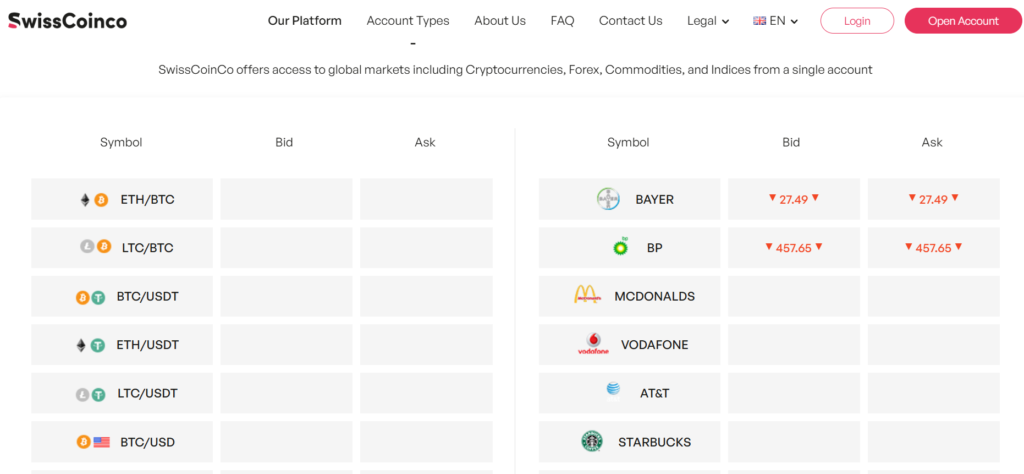

Products and Services | Stocks, Forex, Indices, Cryptocurrencies, Commodities |

Minimum Deposit | €10,000 |

Maximum Leverage | 1:20 to 1:1000 |

Account Types | Standard, Advanced, Platlnum, Expert, VIP, Professional |

Trading Platforms | SwissCoinCo |

Deposit & Withdrawal | Bank Wire Transfers, Credit/Debit Cards, eWallets |

Customer Support | Email: support@swisscoinco.com Phone: +442038687828 |

Services or Products

SwissCoinCo offers a range of tradable assets, including stocks, forex, indices, cryptocurrencies, and commodities, providing traders with diverse investment options. This variety allows for portfolio diversification and potential exposure to different market trends.

If you have lost money to companies like ICE FX; or HugosWay; please report it to us on our report a scam form.

Trading Platform & Leverages

The SwissCoinCo trading platform is web-based, allowing traders to access it from various devices. This accessibility is convenient for those who prefer to trade on the go. However, the platform’s functionality and user experience remain unclear without in-depth testing.

Leverage options offered by SwissCoinCo range from a conservative 1:20 to a highly risky 1:1000. While higher leverage can potentially amplify profits, it also significantly increases the risk of substantial losses. Traders must carefully consider their risk tolerance before choosing a leverage level.

Spreads and Cost of Trading

SwissCoinCo offers a range of account types with varying spreads and commissions tailored to different levels of traders. The minimum spreads start from 1.5 pips for the Standard and Silver accounts, decreasing to as low as 0.8 pips for the Gold account, and potentially to 0 pips for the VIP account. This tiered approach allows traders to select an account that aligns with their trading frequency and strategy, offering competitive pricing as they move up the account tiers. However, without precise information on commissions and fees associated with each account type, it’s difficult to assess the overall cost of trading on SwissCoinCo. Traders should carefully evaluate the pricing structure and compare it to other brokers before making a decision.

License and Regulations

- Legal Warning Against SwissCoinCo: Due to the lack of regulation, traders should be wary of potential legal issues or difficulties recovering funds in case of disputes.

Deposit and Withdrawal Methods

SwissCoinCo offers a variety of secure deposit methods, including bank wire transfers, credit/debit cards, and popular electronic wallets. The reflection time for deposits varies by method, with credit/debit cards and eWallets processing within minutes, while bank wire transfers take 3-5 days. SwissCoinCo provides six account types with varying initial deposit requirements: Standard (€10,000), Advanced (€25,000), Platinum (€100,000), Expert (€250,000), VIP (€500,000), and Professional (€2,000,000). Accounts can be held in USD, EUR, or GBP, with local currency funding available without extra fees.

Withdrawals require account verification for KYC compliance, involving proof of identity and residence. Once verified, traders can submit a signed withdrawal form, with requests processed within a few days. The time taken for the funds to reach the trader’s account depends on the withdrawal method used. Withdrawal requests can be canceled if unprocessed, ensuring flexibility for traders.

SwissCoinCo Pros and Cons

Pros | Cons |

Wide range of tradable assets | Unregulated platform |

User-friendly web platform | Short establishment period |

Advanced charting tools (if functional) | High minimum deposit requirements |

Multi-device support | Unclear spreads and commissions |

Why Dealing With An Unregulated Broker Is Risky

Unregulated brokers pose a significant risk to traders. Here’s why:

- Lack of Investor Protection: Regulated brokers are required to adhere to strict rules designed to protect investors. Unregulated platforms have no such obligation.

- Potential for Fraud: Without oversight, the risk of fraudulent activity increases.

- Difficulty Recovering Funds: In the case of disputes, recovering funds from an unregulated platform can be a lengthy and challenging process.

Client Feedback

Limited information is available regarding client experiences with SwissCoinCo. Due to the platform’s newness, it’s difficult to assess past customer satisfaction.

How Can “Reviewsadvice” Help You If You Get Scammed?

While recovering funds from a scam can be difficult, “Reviewsadvice” aims to educate potential investors and help them avoid these situations altogether or you can report to us today using the form below.

File A Complaint Against Scammers

Final Thought

SwissCoinCo’s lack of regulation raises significant red flags. Before considering this platform, it’s crucial to prioritize safety and choose a well-established, regulated broker. There are numerous reputable options offering diverse tradable assets and user-friendly platforms. Don’t risk your hard-earned money on an unproven platform. Remember, investing involves inherent risks, but choosing a regulated broker mitigates some of those risks and provides essential investor protection.