- Lack of Regulation: OneTouchInvest operates without the necessary licenses from reputable financial authorities, rendering it a high-risk platform. The Financial Conduct Authority (FCA) has issued a warning against them, highlighting the potential for financial loss.

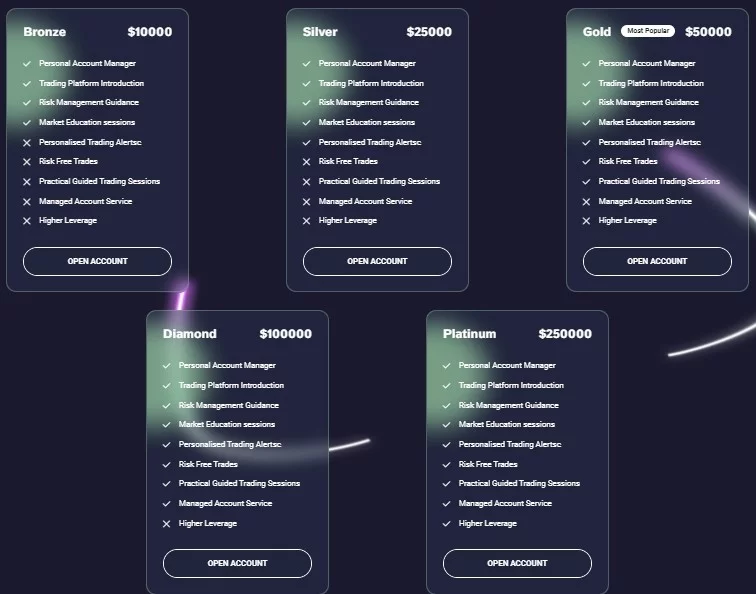

- Deceptive Marketing: The platform boasts high leverage and tight spreads, but these claims are often misleading. High leverage can amplify losses significantly, and hidden fees can erode profits.

- Missing Demo Account: Legitimate brokers offer demo accounts to allow traders to practice risk-free. OneTouchInvest’s absence of this essential feature raises red flags.

- Unclear Fees: Transparency regarding fees and commissions is crucial. OneTouchInvest shrouds these costs in secrecy, indicating a potential for hidden charges.

- Cryptocurrency Preference: Scammers often favor crypto payments due to their difficulty in tracing and reversing. OneTouchInvest’s promotion of crypto deposits adds to its dubious nature.

OneTouchInvest presents itself as a sleek and sophisticated trading platform, boasting of exceptional trading conditions and a user-friendly interface. However, beneath this alluring facade lies a cunning scam operation designed to exploit unsuspecting traders. This comprehensive review will dissect the deceptive tactics employed by OneTouchInvest and equip you with the knowledge to safeguard your hard-earned money

Company Overview

Feature | Description |

Company Name | OneTouchInvest |

Website | OneTouchInvest.com (domain registered several years ago) |

Regulation Status | Unregulated (Blacklisted by FCA) |

Products | Forex, Indices, Commodities, Precious Metals, Stocks, Cryptocurrencies |

Trading Platform & Leverages

OneTouchInvest offers a web-based platform with basic functionalities. While it may seem beginner-friendly, experienced traders will find it lacking in advanced tools and features. Notably absent are crucial elements like automated trading and a demo account.

The platform advertises high leverage of 1:100 or 1:500, exceeding legal limits in many jurisdictions. While leverage can magnify profits, it also amplifies losses, making trading highly risky.

If you have lost money to companies like CanaCapital24; or WisecapitalX; please report it to us on our report a scam form.

Spreads and Cost of Trading

The advertised spread for EUR/USD appears competitive with 1 pip. However, the lack of transparency regarding commissions raises concerns about hidden fees. A legitimate broker will clearly outline all trading costs.

License and Regulations

Legal Warning Against OneTouchInvest:

The FCA’s warning exposes the platform’s lack of regulation. This absence places traders at significant risk, as they have no recourse to financial authorities in case of disputes or fraudulent activity.

Deposit and Withdrawal Methods

OneTouchInvest offers various deposit methods, including credit/debit cards, wire transfers, and cryptocurrencies. However, the platform’s preference for crypto deposits, which are difficult to trace and recover, strengthens suspicions about its legitimacy.

OneTouchInvest Pros and Cons (Table format)

Pros | Cons |

Basic user interface (may appeal to beginners) | Unregulated platform (high risk) |

Hidden fees likely | |

No demo account | |

Preference for crypto deposits (difficult to trace) |

Why Dealing With An Unlicensed Broker Is Risky

Unlicensed brokers operate outside legal frameworks, leaving traders vulnerable to various risks:

- Fund Misappropriation: Without regulatory oversight, there’s no guarantee your funds are secure. Unlicensed brokers can easily misappropriate deposited capital.

- No Dispute Resolution: If disputes arise, you won’t have access to financial authorities for mediation, making recovering lost funds extremely difficult.

- Unfair Trading Practices: Unregulated platforms can manipulate prices or engage in other unfair practices to exploit traders.

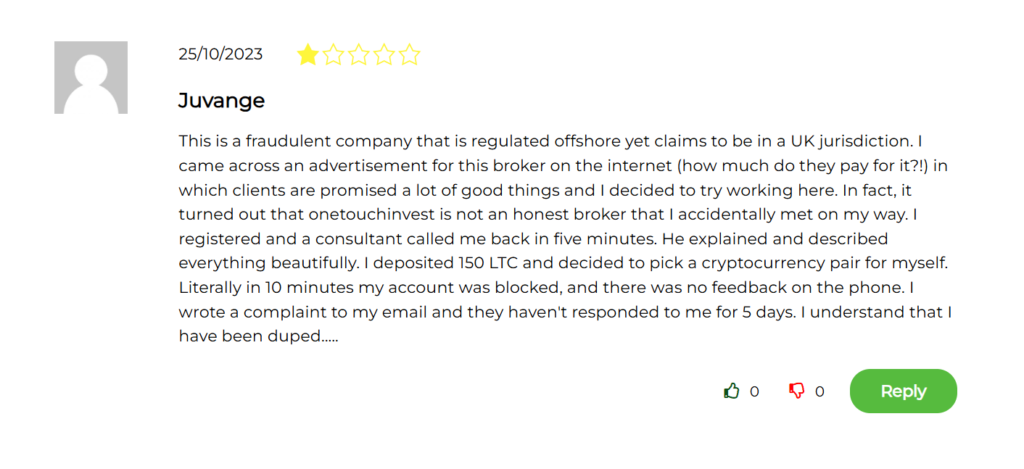

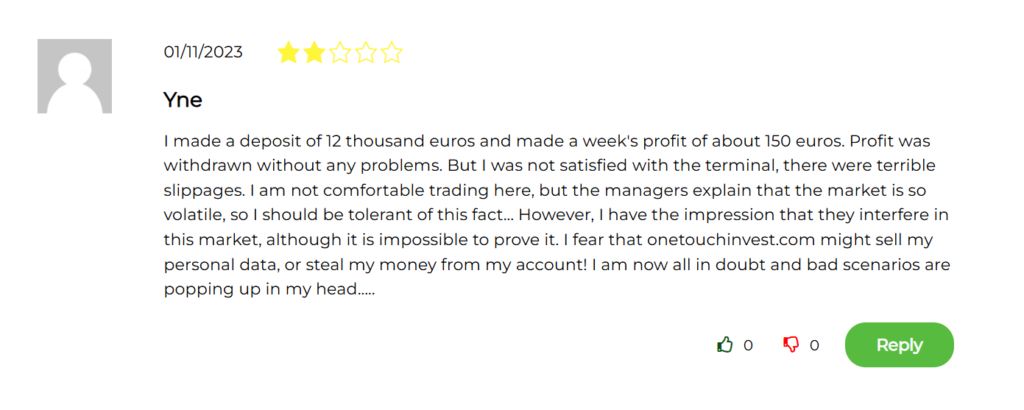

Client Feedback

Unfortunately, due to the platform’s deceptive nature, reliable client feedback is likely scarce. But, the reviews we found are mostly.

How Can “Reviewsadvice” Help You If You Get Scammed?

If you’ve fallen victim to OneTouchInvest’s scam, immediate action is crucial. Reviewsadvice recommends seeking professional assistance for fund recovery or You can report to us today using the form below.

However, it’s important to note that recovering funds from scams is challenging and success cannot be guaranteed.

File A Complaint Against Scammers

Final Thought

OneTouchInvest is a clear example of a deceptive broker scheme. By understanding the red flags and prioritizing regulated platforms, you can protect yourself from financial losses. Remember, due diligence is vital before entrusting your hard-earned money to any trading platform. Choose a reputable, licensed broker with transparent fees and a proven track record to ensure a secure and rewarding trading experience.