- No Regulatory Oversight: The most glaring red flag is the absence of a valid financial license. This means Hudson Trust operates without any regulatory scrutiny, leaving investors completely unprotected.

- Website Discrepancies: The claim of being established in 2006 contradicts the website’s registration date in September 2023. This inconsistency raises serious doubts about the company’s legitimacy.

- Limited Contact Information: The lack of a publicly available phone number hinders effective communication and transparency, which are essential in a reputable financial institution.

- Unrealistic Promises: Guaranteeing “the highest return on investment” is a common tactic used by scam brokers to lure unsuspecting investors. Such promises are often too good to be true.

Company Overview

Feature | Details |

Claimed Establishment | 2006 |

Website Registration | September 2023 |

Headquarters | Zurich, Switzerland (Claimed) |

Regulation | Unregulated |

Offered Products | Stocks, forex, bonds, ETFs, options, commodities, cryptocurrency |

Account Types | Trial, Term Deposit, Savings Plan, Tax-Free Account, Trust Account, Retirement Account |

Services or Products

Hudson Trust offers a variety of financial products, including trading and savings accounts. However, the lack of regulatory oversight casts doubt on the security and legitimacy of these offerings.

If you have lost money to companies like ICE FX; or Coindex; please report it to us on our report a scam form.

Trading Platform & Leverages

Information about the trading platform and leverage provided by Hudson Trust is unavailable. This lack of transparency is another red flag, as reputable brokers openly disclose this crucial information.

Spreads and Cost of Trading

Details about trading costs, such as spreads and commissions, are absent from the website. This omission makes it impossible to assess the overall cost of trading with Hudson Trust.

License and Regulations

Hudson Trust is not licensed or regulated by any financial authority. Operating without a license exposes investors to significant risks, including fraud, theft, and loss of funds.

Legal Warning Against Hudson Trust

There is no specific legal warning against Hudson Trust mentioned in the provided information. However, the absence of a license is itself a major legal concern.

Deposit and Withdrawal Methods

The deposit and withdrawal methods offered by Hudson Trust are unknown. It’s essential to be cautious about providing personal financial information to unregulated entities.

Hudson Trust Pros and Cons

Pros | Cons |

Offers various account types | Unregulated |

No publicly available phone number | |

Website inconsistencies |

Why Dealing With An Unlicensed Broker Is Risky?

Dealing with an unlicensed broker like Hudson Trust exposes investors to numerous risks:

- Lack of Protection: Investors have no legal recourse in case of fraud or disputes.

- Security Breaches: Sensitive financial information may be compromised.

- Market Manipulation: Unregulated brokers can engage in fraudulent practices.

- Loss of Funds: There is a high risk of losing invested capital.

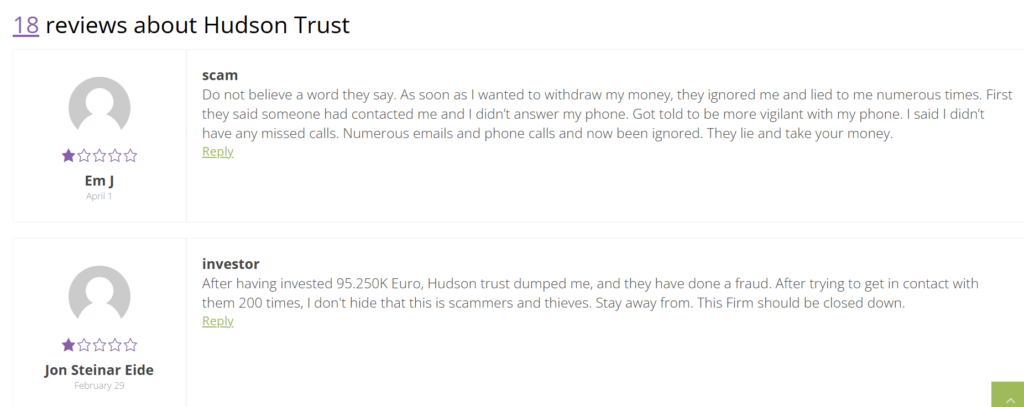

Client Feedback

When we were looking for the reviews about Hudson Trust, we found several negative reviews about their activities. Most of them are related to withdrawal issues, account holding problems, etc.

How Can “Reviewsadvice” Help You If You Get Scammed?

If you suspect you’ve been scammed by Hudson Trust or any other broker, seeking professional advice is crucial. “Reviewsadvice” can guide recovering lost funds, reporting the scam, and protecting yourself from future scams or you can report to us today using the form below.

File A Complaint Against Scammers

Final Thought

Based on the available information, Hudson Trust exhibits all the hallmarks of a scam broker. The absence of a license, website inconsistencies, and unrealistic promises should be a clear warning sign for any potential investor. It is strongly advised to avoid this platform and choose a regulated broker for your financial activities.