While Etora Grand might seem appealing, the lack of regulation raises serious concerns:

- Unreliable Security: Without regulatory oversight, there’s no guarantee that Etora Grand safeguards your funds. Reputable brokers segregate client funds from company assets, a practice absent in Etora Grand’s claims.

- Potential for Fraud: The lack of regulation exposes you to potential scams. Unscrupulous brokers can manipulate pricing or entirely disappear with your funds.

- Limited Dispute Resolution: If you encounter issues with Etora Grand, resolving them becomes significantly more challenging without a regulatory body to intervene.

Etora Grand presents itself as a versatile online brokerage offering access to forex, indices, commodities, shares, and CFDs. They advertise educational resources, tight spreads, and multiple trading platforms. However, a closer look reveals a glaring red flag – a complete lack of regulation. This Etora Grand scam broker review will delve into the details to help you make an informed decision.

Company Overview

Feature | Details |

Company Name | |

Claimed Country of Registration | United Kingdom |

Regulation | None |

Market Instruments | Forex, Indices, Commodities, Shares, CFDs |

Services or Products

Etora Grand offers trading in various financial instruments:

- Forex: Major, minor, and exotic currency pairs.

- Indices: Major stock indices from global markets.

- Commodities: Gold, silver, oil, natural gas, etc.

- Shares: Individual company stocks listed worldwide.

- CFDs: Contracts for Difference to speculate on asset prices.

If you have lost money to companies like AceFxPro; or Braxton WM; please report it to us on our Report a Scam form.

Trading Platform & Leverages

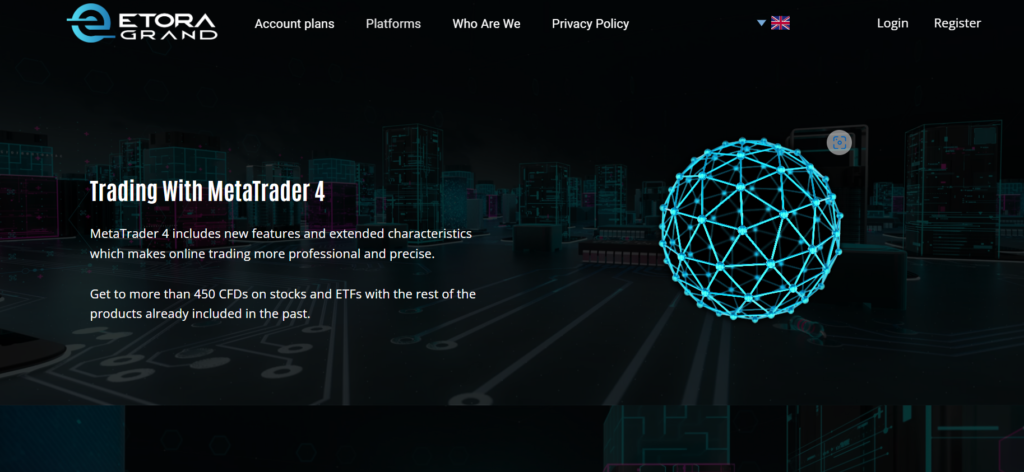

Etora Grand provides three trading platforms:

- MetaTrader 4 (MT4): Popular platform with advanced features.

- Webtrader: Web-based platform for trading directly from a browser.

- Mobile Trading App: Trade on the go with iPhone and Android compatibility.

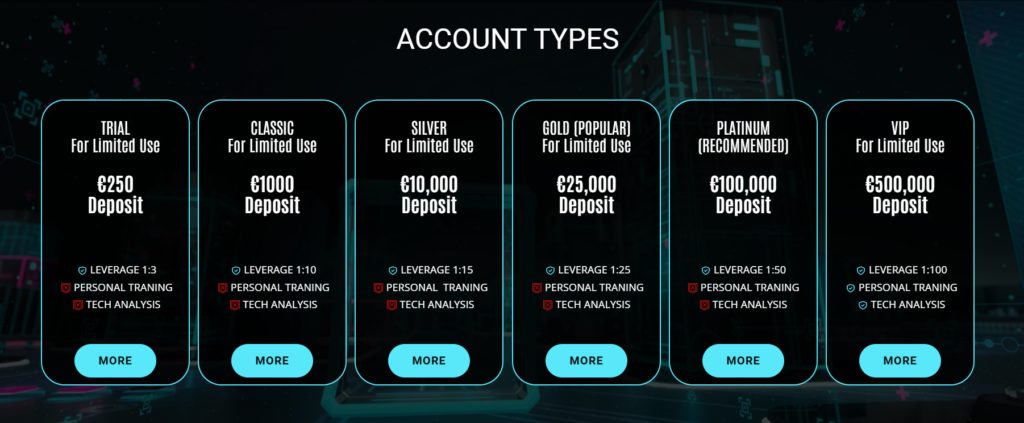

Leverage varies by account type:

- Basic, Classic, Silver, Gold, Platinum: Up to 1:100

- VIP: Up to 1:200 (maximum offered can be adjusted based on client assessment)

Important Note: High leverage can magnify both profits and losses. Always trade responsibly and understand the risks involved.

Spreads and Cost of Trading

Etora Grand claims competitive spreads and commission structures:

- Basic, Classic, Silver, Gold, Platinum: Spreads from 1 pip with no commission.

- VIP: Fixed spreads for forex trading.

Always confirm the latest spreads and commission structures before depositing funds.

License and Regulations

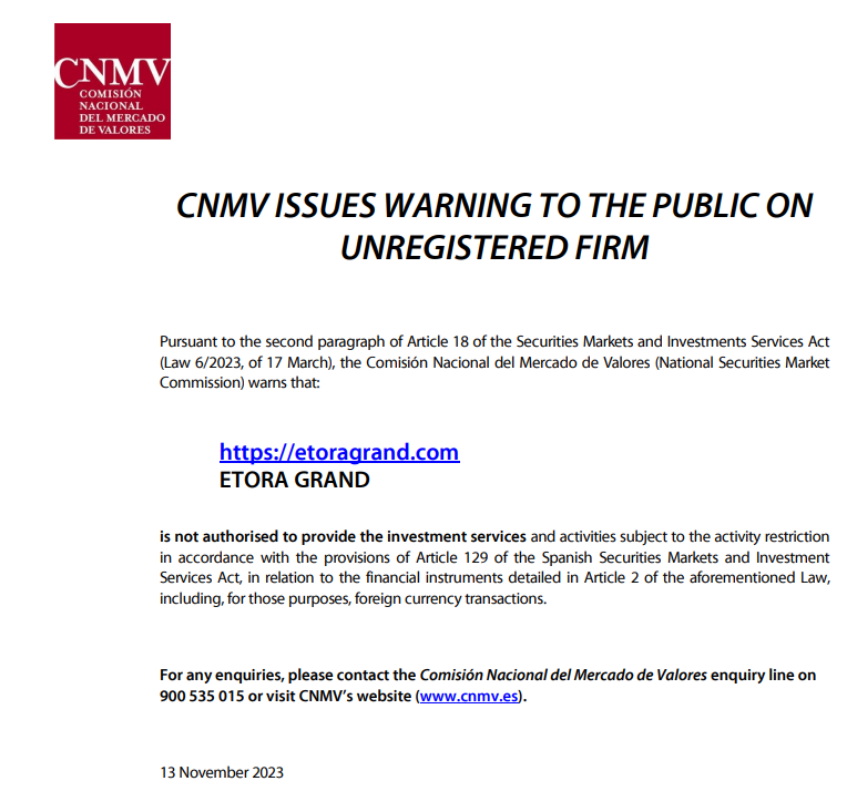

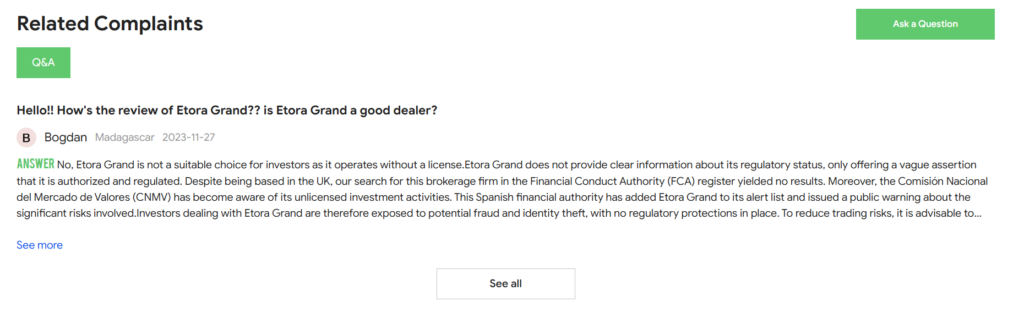

This is where the biggest red flag appears: Etora Grand claims to be registered in the UK, but a search of the Financial Conduct Authority (FCA) register yields no results. Additionally, the Spanish financial authority, Comisión Nacional del Mercado de Valores (CNMV), has issued a warning against Etora Grand for offering unauthorized investment services.

Legal Warning Against Etora Grand: The CNMV warning highlights the significant risks associated with dealing with an unlicensed broker.

Deposit and Withdrawal Methods

Etora Grand doesn’t disclose its deposit and withdrawal methods. This lack of transparency is another red flag. Reputable brokers provide clear information on supported payment methods and processing times.

Etora Grand Pros and Cons

Pros | Cons |

Wide range of instruments | Unregulated broker |

Educational opportunities (claimed) | Limited information on trading conditions and fees |

Multiple trading platforms | Potential for fund mismanagement or scams |

Competitive spreads (claimed) | No regulatory oversight for dispute resolution |

Why Dealing With An Unlicensed Broker Is Risky

Trading with an unlicensed broker exposes you to significant risks:

- Fund Security: Unregulated brokers may not segregate client funds, putting your money at risk.

- Fraudulent Activities: Reputable regulators hold brokers accountable, reducing the risk of fraud.

- Dispute Resolution: Unlicensed brokers offer minimal options for resolving conflicts.

Client Feedback

Due to the lack of regulatory oversight, independent client feedback on Etora Grand is scarce. This further reinforces the caution against using this broker.

How Can “Reviewsadvice” Help You If You Get Scammed?

Unfortunately, recovering funds lost to a scam broker can be extremely difficult. While “Reviewsadvice” can’t guarantee a successful outcome, we can provide resources and information to help you report the scam to relevant authorities or You can report to us today using the form below.

File A Complaint Against Scammers

Final Thought

Etora Grand’s lack of regulation is a massive red flag. Your hard-earned money deserves better protection. We strongly advise against using Etora Grand and recommend seeking other legitimate brokers for your precious investment.