Is Double Capitals Legit or Scam?

Double Capitals is highly likely a scam. While it paints itself as a legitimate cryptocurrency broker, multiple red flags suggest otherwise. Lack of regulatory licenses, negative client reviews, and unrealistic promises of high returns paint a clear picture of a potentially fraudulent operation.

Company Overview

Regulated By: | No Regulations |

Is This Company Safe? | No |

Known Websites: | |

Have Warnings From: | BaFin |

Registered In: | N/A |

Operating Since: | 2023 |

Trading Platforms: | Web trader |

Maximum Leverage: | 1:400 |

Minimum Deposit: | 12.500 EUR |

Deposit Bonus: | Available |

Trading Assets: | Cryptos, forex, indices, shares, commodities |

Free Demo Account: | Not Available |

How To Withdraw From This Company? | Considering the non-transparent trading platform, shady withdrawal, and bonus policy, you can expect various withdrawal issues. In case you experience any delay or problem during the withdrawal procedure, feel free to send us a message and book your refund consultation. |

Services or Products

Double Capitals claims to offer a wide range of cryptocurrency trading services, including:

- Forex – GBP/EUR, AUD/SGD

- Commodities – natural gas, palladium

- Shares – IBM, AMD

- Indices – NASDAQ, DowJones

- Cryptos – BTC, ETH

However, the lack of transparency and potential regulatory issues make it impossible to verify the legitimacy or safety of these services.

If you have lost money to companies like Inftrade, or Puprime; please report it to us on our Report a Scam form.

Trading Platform & Leverages

Meta Trader and cTrader are the most dependable trading software packages. It is quite difficult to alter any information on the platform with them. which is the main problem with con artists.

So brace yourself if the corporation provides a web trader like DoubleCapitals. These kinds of sites are untrustworthy since brokers can change anything you see and freeze your account.

Furthermore, registered brokers would not provide ordinary traders with leverage of 1:400. That’s among the simplest methods for identifying con artists.

Spreads and Cost of Trading

We found with great sadness that traders can only receive below-average spreads if they deposit 150k EUR. The initial ones begin at 2.8 pip.

Furthermore, the corporation allows enough room for manipulation in any of the DoubleCapitals accounts by not disclosing commissions, overnight swaps, or any other expenses.

License and Regulations

It is difficult to verify the company’s licensing because they withhold any legal details, particularly addresses. To be fair, though, if they had any, they would make it known openly. They don’t disclose the license number even though they boast of being regulated.

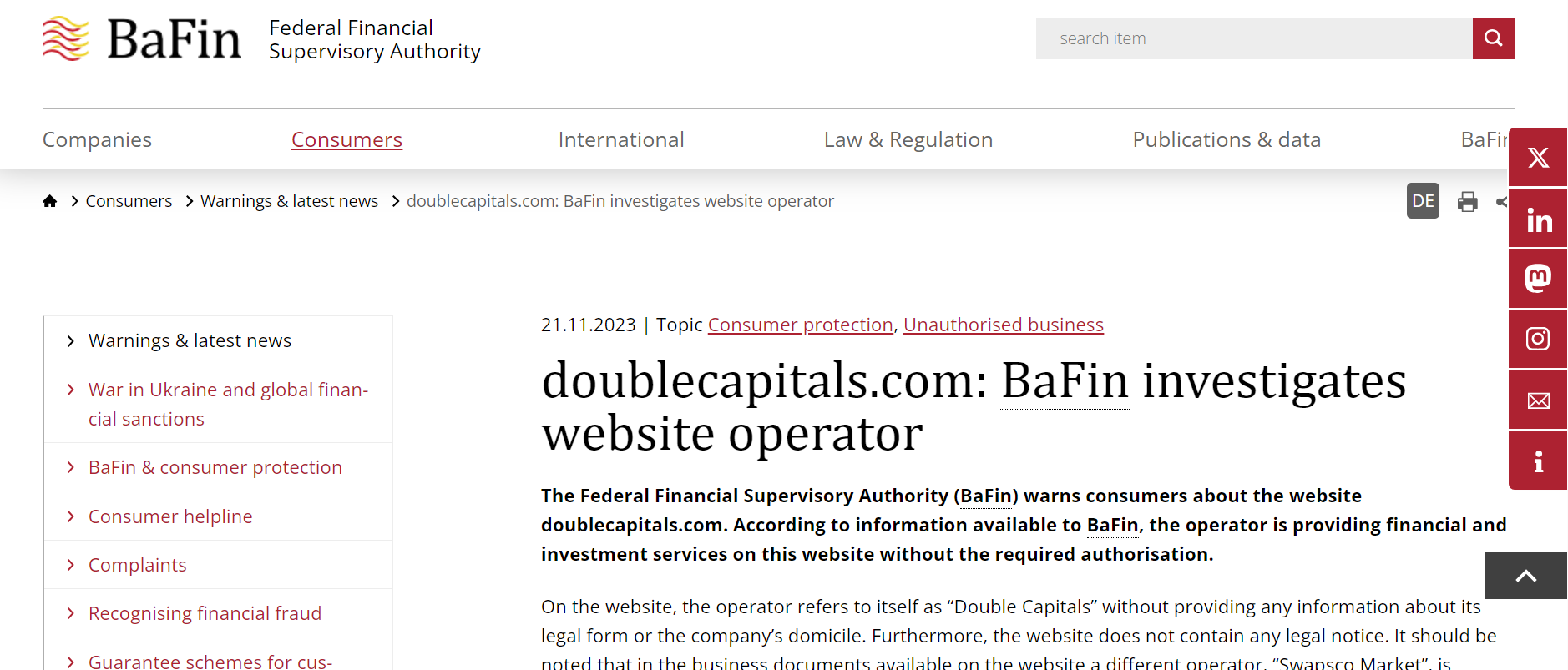

Legal Warning Against Double Capitals

We checked a few Tier 1 regulatory databases, including CFTC, ASIC, BaFin, and FCA, just in case. In summary, the outcomes were underwhelming. Rather than rules, we discovered a caution from BaFin, one of the strictest regulators. We are all aware that Germans are not to be joked with. As a result, you may be certain that a warning from this organization is not sent inadvertently.

Deposit and Withdrawal Methods

There are no costs associated with credit card withdrawals from the firm. It’s unclear, though, if there will be any other techniques, like crypto.

The dubious aspect is that the business processes withdrawals 30 days after the account is opened. The bonus is another item that will make the DoubleCapitals withdrawal procedure take longer.

Double Capitals Pros and Cons

Pros | Cons |

None identified | Unlicensed and unregulated |

Potential scam | |

Negative client reviews | |

Unrealistic profit promises | |

Limited information on fees and costs |

Why Dealing With An Unlicensed Broker Is Risky?

Dealing with an unlicensed broker like Double Capitals carries significant risks:

- No legal recourse: If things go wrong, you have limited legal options to recover your funds.

- Security concerns: Your funds and personal information might not be secure.

- Fraudulent activities: Unlicensed brokers often engage in manipulative practices and scams.

- High risk of losing money: The lack of regulation increases the risk of losing your entire investment.

Client Feedback

Client reviews of Double Capitals paint a grim picture. Many users report difficulties withdrawing funds, unresponsive customer service, and manipulative trading practices. These red flags further solidify the platform’s lack of legitimacy.

How Can “Reviews Advice” Help You If You Get Scammed?

Unfortunately, recovering funds from a scam can be challenging. However, “Reviewsadvice” can help you by:

- Report the scam to relevant authorities: Contact your local financial regulator and file a complaint.

- Seek legal advice: Depending on the severity of the scam, legal action might be an option.

- Spread awareness: Warn others about your experience to prevent others from falling victim.

We will provide you free consultation and recovery service recommendations to help you recover the lost funds or you can report to us today by the below form.

Get Your Money Back from Scammers.

Final Thought

Investing in cryptocurrencies should be done with caution and due diligence. Avoid Double Capitals at all costs. The lack of regulatory oversight, negative client reviews, and unrealistic promises are clear indicators of a potential scam. Stick to licensed and reputable platforms to protect your hard-earned money and invest safely in the cryptocurrency market. Remember, if something seems too good to be true, it probably is.