Is Profiton Legit or Scam?

The short answer: proceed with extreme caution. While Profiton boasts of its user-friendly platform and generous bonuses, red flags abound, raising serious concerns about its legitimacy. The lack of a valid license from a reputable financial authority is a major cause for alarm. Additionally, negative client reviews paint a picture of manipulative tactics, hidden fees, and difficulties with withdrawals.

Company Overview: A Glimmer of Doubt

Broker status: | Unregulated Broker |

Regulated by: | No regulation |

Operating Status: | Active Forex Trading Fraud |

Known Websites: | |

Blacklisted as a Scam by: | BaFin |

Owner: | N/A |

Headquarters Country: | N/A |

Foundation Year: | June 2023 |

Online Trading Platforms: | Web trader |

Mobile Trading: | Not available |

Minimum Deposit: | $10,000 |

Deposit Bonus: | Up to 40% |

CFD Trading Option: | No |

Crypto Asset Trading: | Yes – BTC, ETH, LTC, XRP |

Available Trading Instruments: | Crypto |

Maximum Leverage: | 1:500 |

Islamic Account: | Not available |

Free Demo Account: | Not available |

Accepts US clients: | US clients are not accepted |

Our thought | Better look for an alternative if you wish to trade with peace of mind! |

Services or Products: Beyond the Surface

Not every instrument class that is offered is disclosed on the website itself. All you’ll see are meaningless paragraphs summarizing the basics of trading CFDs, cryptocurrencies, and forex. There are no thorough asset listings available, or at the very least, no examples showing the precise cost or commission every turn. The platform preview displays this one class:

- Crypto (BTC, ETH, LTC, ADA, DOT, LUNA, SOL, ZEC, XRP)

If you have lost money to companies like Alphanis, or Cbcgroup-lu; please report it to us on our report a scam form.

Trading Platform & Leverages: A Questionable Canvas

The fact that this trade site offers certain prohibited trading circumstances is only more evidence that it could never be a certified EEA brand. That refers to the leverage ratio reaching a maximum of 1:500. For the purpose of safeguarding traders through risk management, the EEA limitation is carefully maintained at 1:30.

This financial crook uses its domain to mimic the typical, unskilled web trader. You’ve already had an opportunity to familiarize yourself with this fraudulent trading terminal if you’ve read any of our earlier evaluations.

Advertised as comprehensive, user-friendly, and straightforward, the real drawbacks are overlooked. A software solution this basic gives the appearance that trading is simple and undemanding. Cons aim to get that exact result, so avoid falling into their traps and never accept anything less than cTrader, MT4, or MT5.

Spreads and Cost of Trading: The Hidden Costs

Profiton’s advertised spreads seem competitive on the surface. However, hidden fees and commissions can quickly erode your profits. Client reviews mention unexpected charges and difficulties in calculating the true cost of trading. Transparency in pricing and fees is crucial for informed decision-making, and Profiton falls short in this crucial aspect.

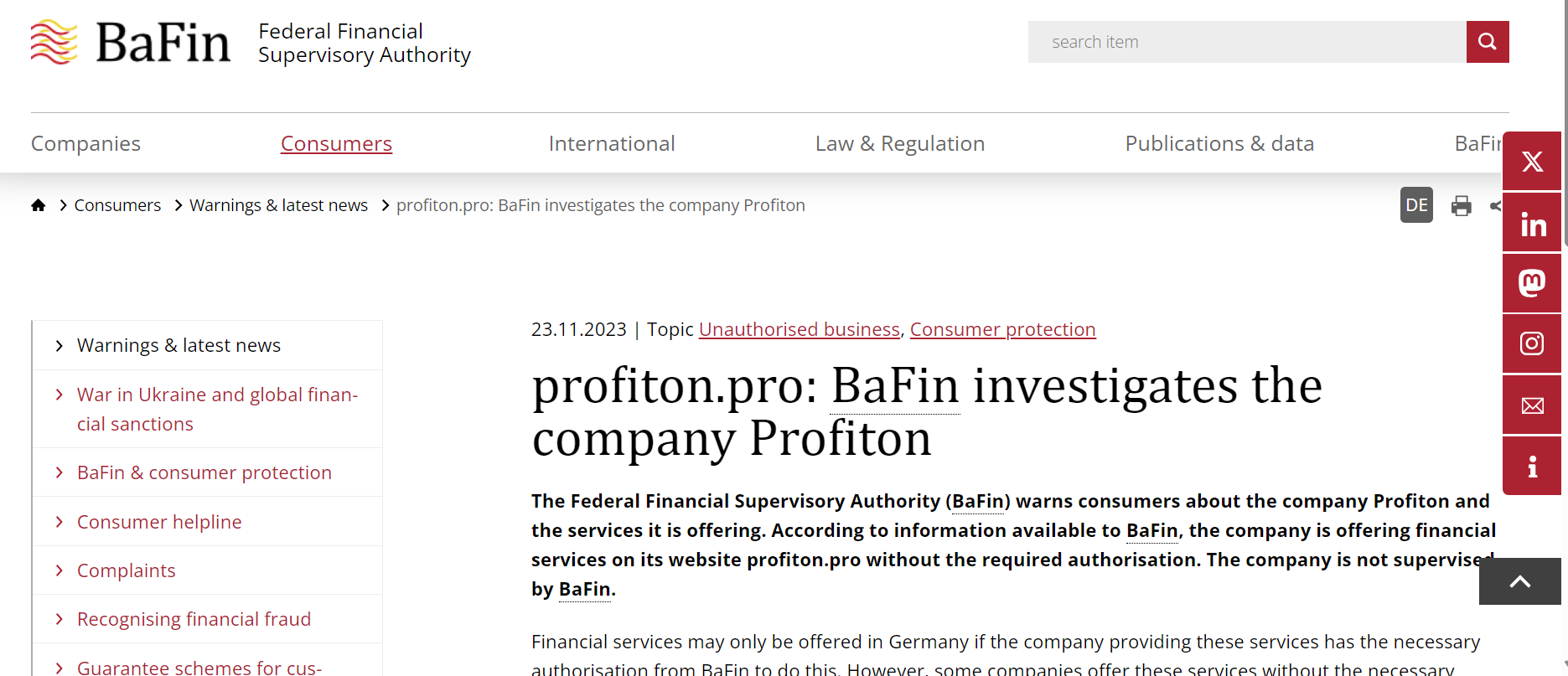

License and Regulations: A Glaring Absence

The most concerning aspect of Profiton is its lack of any valid license from a reputable financial authority. This lack of oversight leaves you vulnerable to fraudulent activities, manipulation, and difficulty recovering your funds. Regulated brokers are accountable to strict financial regulations, ensuring fair trading practices and investor protection. Profiton’s absence from any regulatory body is a major red flag.

Legal Warning Against Profiton: Heed the Siren Song

We assiduously searched through a number of Tier 1 databases maintained by top financial agencies in an attempt to find hints on their legal status. FCA, CySEC, FINMA, CONSOB, and NFA are a few of them. But all we discovered was a BaFin alert.

Deposit and Withdrawal Methods: A Murky Path

There are no legal documents on this dubious site, thus the compensation terms are not disclosed in any way. The fact that there is no realistic trading at all worries us even more about taking profits. You ought to thus make an effort to withdraw your deposited funds promptly.

Strangely, the rewards permit the use of credit cards, given that deposits are limited to cryptocurrency channels. Naturally, this goes against every AML measure that licensed brokers have taken!

Profiton Pros and Cons: Weighing the Options

Pros | Cons |

User-friendly platform (claimed) | Unregulated |

High-risk leverage options | |

Hidden fees and charges | |

Negative client reviews |

Why Dealing With An Unlicensed Broker Is Risky: Don’t Gamble Your Future

Trading with an unlicensed broker like Profiton exposes you to a multitude of risks:

- Fraudulent activities: Unregulated brokers can manipulate markets, steal your funds, and engage in illegal practices with impunity.

- No investor protection: In case of disputes or losses, you have no recourse to regulatory bodies or compensation schemes.

- Hidden fees: Unregulated brokers can impose unexpected fees and charges, eroding your profits and making it difficult to withdraw your funds.

- Limited access to justice: If you encounter issues, pursuing legal action against an unregulated entity can be complex and expensive.

Investing with an unlicensed broker is akin to gambling with your financial future. The potential for losses and the lack of legal recourse make it a gamble you simply cannot afford.

Client Feedback: A Chorus of Disappointment

Client reviews of Profiton paint a bleak picture, rife with complaints and allegations of unfair practices. Clients report:

- Manipulation of trades: Suspicious market movements and unexplained losses raise concerns about potential market manipulation by Profiton.

- Difficulties with withdrawals: Many clients complain about delays, hidden fees, and even blocked withdrawals when attempting to access their funds.

- Unresponsive customer support: Clients report facing unresponsive and unhelpful customer service, further amplifying their frustration and difficulty resolving issues.

- Bonus traps: Advertised bonuses often come with unrealistic trading requirements, making it nearly impossible to withdraw the bonus funds.

These consistent negative reviews highlight the potential dangers of dealing with Profiton and serve as a stark warning for potential investors.

How Can “Reviews Advice” Help You If You Get Scammed?

If you’ve unfortunately fallen victim to a scam broker like Profiton, “ReviewsAdvice” can offer valuable assistance:

- Documenting your experience: We can help you gather and document all relevant information about your interactions with Profiton, including screenshots, emails, and transaction records.

- Reporting the scam: We can guide you through the process of reporting the scam to relevant authorities and regulatory bodies.

- Seeking legal advice: We can connect you with legal professionals specializing in financial scams to explore potential options for recovering your funds.

- Sharing your story: We can help you share your experience with other potential investors to raise awareness and prevent others from falling prey to similar scams.

Remember, you’re not alone. “Reviews Advice” is here to support you through this difficult process.

We Will provide you recovery service recommendations, which will help you in recovering the lost funds or you can report to us today by the below form.

Get Your Money Back from Scammers.

Final Thought: Seek Secure Shores, Avoid the Storm

The evidence against Profiton is overwhelming. Its lack of regulation, questionable practices, and negative client reviews paint a clear picture of a platform best avoided. The potential financial risks and emotional distress are simply not worth it.

Instead, invest your time and money with reputable, licensed brokers who prioritize transparency, fair trading practices, and investor protection. Your financial security and peace of mind are far too valuable to gamble away on a platform like Profiton. Remember, always prioritize your safety and choose wisely when navigating the world of online trading.