- Unregulated: CFX Fund operates without the supervision of established financial authorities. This lack of oversight exposes investors to potential fraud and limited avenues for dispute resolution.

- High Minimum Deposits: Account tiers start at a hefty $10,000, potentially locking out small-scale investors and hindering accessibility.

- Unclear Fees: CFX Fund lacks transparency regarding spreads and commissions, making it difficult for traders to evaluate the true cost of trading.

- Website Issues: Reported website accessibility problems can disrupt the trading experience and create frustration.

- Limited Reviews: Independent, verified reviews of CFX Fund’s services are scarce, making it challenging to gauge genuine client experiences.

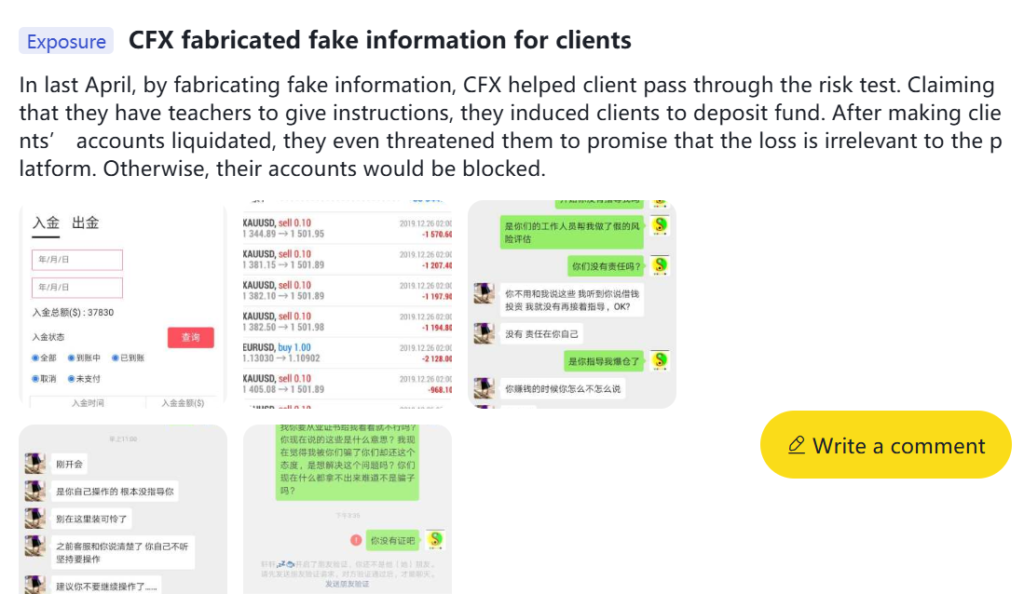

CFX Fund presents itself as a versatile investment platform catering to various risk profiles. However, a closer look reveals a concerning lack of transparency and regulatory oversight, raising significant red flags for potential investors. This review delves into CFX Fund’s offerings, highlighting the inherent risks associated with an unregulated broker.

Company Overview

Feature | Description |

Company Name | CFX Fund |

Headquarters | United Kingdom (Unverified) |

Account Types | Platinum ($250,000), Premium ($100,000), Gold ($50,000), Silver ($25,000), Bronze ($10,000) |

Minimum Deposit | $10,000 |

Customer Support | Email (support@cfxfund.com), Phone (+44-2038076239) |

Services or Products

While the specific services offered by CFX Fund are unclear, their marketing suggests they provide investment opportunities in various financial instruments.

If you have lost money to companies like RockStoneTrust; or WisecapitalX; please report it to us on our report a scam form.

Trading Platform & Leverages

Information regarding the trading platform and leverage options offered by CFX Fund is unavailable on their website (if accessible) or within readily available sources.

Spreads and Cost of Trading

CFX Fund does not disclose information on spreads and commissions, making it impossible for potential clients to assess the true cost of trading on their platform. This lack of transparency is a major red flag.

License and Regulations

Legal Warning Against CFX Fund:

The absence of regulatory oversight from recognized financial authorities like the Financial Conduct Authority (FCA) UK or FINRA (US) is a significant concern. This lack of licensing raises serious doubts about the legitimacy of CFX Fund’s operations.

Deposit and Withdrawal Methods

Details regarding deposit and withdrawal methods offered by CFX Fund are unavailable from their website (if accessible) or independent sources.

CFX Fund Pros and Cons (Table)

Pros | Cons |

Multiple account types | Unregulated |

None | High minimum deposits |

None | Unclear fees |

None | Website accessibility issues |

None | Limited client feedback |

Why Dealing With An Unlicensed Broker Is Risky:

Unlicensed brokers like CFX Fund operate outside the safeguards established by financial regulators. This can put investors at risk of:

- Fraud: Unregulated platforms may be more susceptible to fraudulent activities, potentially leading to the loss of invested funds.

- Limited Dispute Resolution: In case of disputes, investors may have limited recourse with no regulatory body to oversee the broker’s actions.

- Lack of Transparency: Unregulated brokers may be less transparent about their practices, fees, and underlying assets.

- Security Concerns: The safety of your funds might be compromised due to the absence of regulatory oversight on security protocols.

Client Feedback

Independent and verified reviews of CFX Fund’s services are scarce. This lack of reliable investor feedback further reinforces concerns about the platform’s legitimacy.

How Can “Reviewsadvice” Help You If You Get Scammed?

Unfortunately, “Reviewsadvice” cannot directly assist with recovering funds lost through scams. However, we can provide resources and information to help you understand the scam and potentially report it to relevant authorities or You can report to us today using the form below.

Here are some resources that might be helpful:

- Report investment fraud to the Securities and Exchange Commission (SEC): https://www.sec.gov/submit-tip-or-complaint/tips-complaints-resources/report-suspected-securities-fraud-or-wrongdoing

- File a complaint with the Federal Trade Commission (FTC): https://reportfraud.ftc.gov/

- Seek legal counsel specializing in financial fraud.

File A Complaint Against Scammers

Final Thought

CFX Fund’s lack of regulatory oversight, unclear fees, high minimum deposits, and limited information raise significant red flags. Given the potential risks involved, it is strongly advised to avoid CFX Fund and seek out a reputable, licensed broker for your investment needs. Always prioritize thorough research and transparency