Here’s why CanaCapital24 raises scam concerns:

- Lack of Transparency: CanaCapital24 fails to disclose its regulatory status or licensing information. Legitimate brokers are required to be licensed by reputable financial authorities.

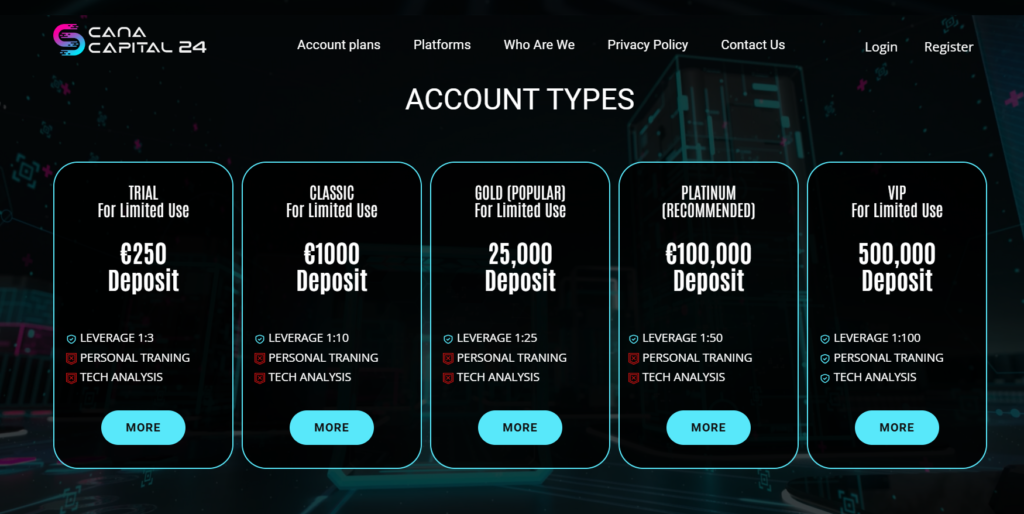

- Exorbitant Leverage Claims: The advertised leverage rates (up to 500:1) are far above what responsible brokers offer. High leverage can lead to significant financial losses.

- Unrealistic Promises: The website emphasizes tight spreads and high leverage, potentially luring novice traders with unrealistic profit expectations.

- Generic Customer Service: The website promotes “multilingual customer service” without specifying languages or support channels.

- Missing Information: The “About Us” section lacks crucial details about the company’s background and experience.

Cana Capital 24 presents itself as a versatile trading platform, boasting a range of features and benefits. However, upon closer inspection, several red flags raise concerns about its legitimacy. This review dives deep into CanaCapital24, analyzing its services, regulations, and potential risks to help you make informed decisions.

Company Overview

Feature | Details |

Company Name | Cana Capital 24 |

Website | canacapital24.com (Warning: Potentially risky website) |

Services | Forex, Crypto, Equities, Indices, Commodities |

Trading Platform | Not specified |

Regulation | Not disclosed (Red Flag) |

Services or Products

CanaCapital24 offers trading in various markets, including forex, cryptocurrencies, equities, indices, and commodities. However, the lack of details about tradable instruments and trading conditions raises concerns.

If you have lost money to companies like BisonTradePro; or Deal-X; please report it to us on our report a scam form.

Trading Platform & Leverages

The website doesn’t mention the specific trading platform used. Reputable brokers offer established platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). The advertised high leverage rates (up to 500:1) are a significant red flag, as they carry immense risk of losing your entire investment.

Spreads and Cost of Trading

CanaCapital24 claims tight spreads but doesn’t provide specific figures. Legitimate brokers disclose their spreads and trading costs transparently. Hidden fees and commissions can erode your profits.

License and Regulations

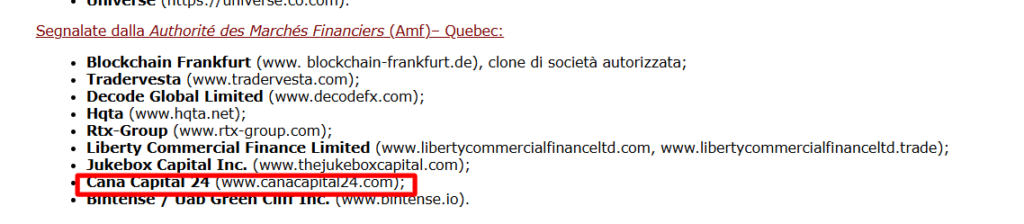

A critical aspect of choosing a broker is its regulatory status. CanaCapital24 fails to disclose any licensing information. Legitimate brokers are authorized and regulated by reputable financial bodies like the Financial Conduct Authority (FCA) (UK), CySEC (Cyprus), or ASIC (Australia). The absence of regulatory oversight raises serious doubts about the safety of your funds.

Legal Warning Against CanaCapital24

Due to the lack of transparency and potential regulatory issues, exercising extreme caution with CanaCapital24 is essential. Consider warnings issued by financial regulators against similar unlicensed brokers.

Deposit and Withdrawal Methods

CanaCapital24 doesn’t disclose its deposit and withdrawal methods. Reputable brokers offer a variety of secure deposit and withdrawal options, including bank transfers, credit cards, and e-wallets. Unclear withdrawal policies can make it difficult to access your funds.

CanaCapital24 Pros and Cons

Pros | Cons |

Wide range of markets (claimed) | Unlicensed and unregulated (Red Flag) |

Tight spreads (claimed) | High leverage (risky) |

Lack of transparency | |

Missing information about the company |

Why Dealing With An Unlicensed Broker Is Risky

Unlicensed brokers operate outside the regulations that protect investors. This exposes you to significant risks, including:

- Loss of Funds: There’s no guarantee you’ll get your money back if the broker goes bust or disappears.

- Unfair Trading Practices: Unlicensed brokers may manipulate prices or execute trades without your consent.

- No Dispute Resolution: If you have a problem with the broker, you may have no legal recourse to recover your losses.

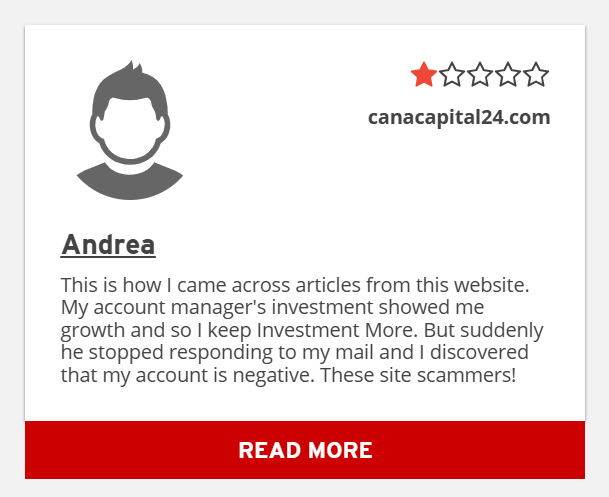

Client Feedback

Independent client reviews can be a valuable source of information. However, due to CanaCapital24’s newness, there may be limited reliable feedback available.

How Can “Reviewsadvice” Help You If You Get Scammed?

Unfortunately, recovering funds lost to a scam broker can be challenging. “Reviewsadvice” aims to educate you about potential scams and help you choose a safe and reliable broker. However, we cannot guarantee recovering lost funds or You can report to us today using the form below.

File A Complaint Against Scammers

Final Thought

CanaCapital24 raises several red flags that suggest it may be a scam broker. The lack of transparency, absence of regulatory oversight, and unrealistic promises should deter any serious investor. Always prioritize licensed and regulated brokers with a proven track record. Conduct thorough research before investing your hard-earned money. When in