Is Munro Financial Planners Limited Legit or Scam?

Unequivocally, Munro Financial Planners Limited is a scam broker. This review will expose the numerous red flags that solidify this claim and help you avoid falling victim to their deceptive practices.

Company Overview

Feature | Description |

Websites | Munrofinancialplannersltd.com, Munrofinancialplannersltd.net |

Operating Status | Active |

Broker Status | Unregulated Scam Broker |

Broker Regulation | No Regulation (Illegal Broker) |

Blacklisted as a Scam by | FCA |

Headquarters Country | UK (allegedly) |

Foundation Year | 2022 |

Minimum Deposit | $100 |

Trading Platforms | WebTrader |

Mobile Trading | Not Available |

Maximum Leverage | 1:100 |

Demo Account | No |

Services or Products

Munro Financial Planners Limited claims to offer Forex and CFD trading on various assets, including currencies, commodities, indices, and shares. However, due to their lack of transparency and illegal operations, the legitimacy of these services is highly questionable.

If you have lost money to companies like Rentalzi, or Firstrade; please report it to us on our report a scam form.

Trading Platform & Leverages

The only platform available is the vague “WebTrader,” which requires account registration before access. This lack of transparency and access raises serious concerns about the platform’s reliability and functionality. Additionally, the offered leverage of 1:100 is significantly higher than what reputable brokers offer, further increasing the risk of significant losses.

Spreads and Cost of Trading

No information regarding spreads or other trading costs is provided on their website. This further highlights their lack of transparency and potential for hidden fees.

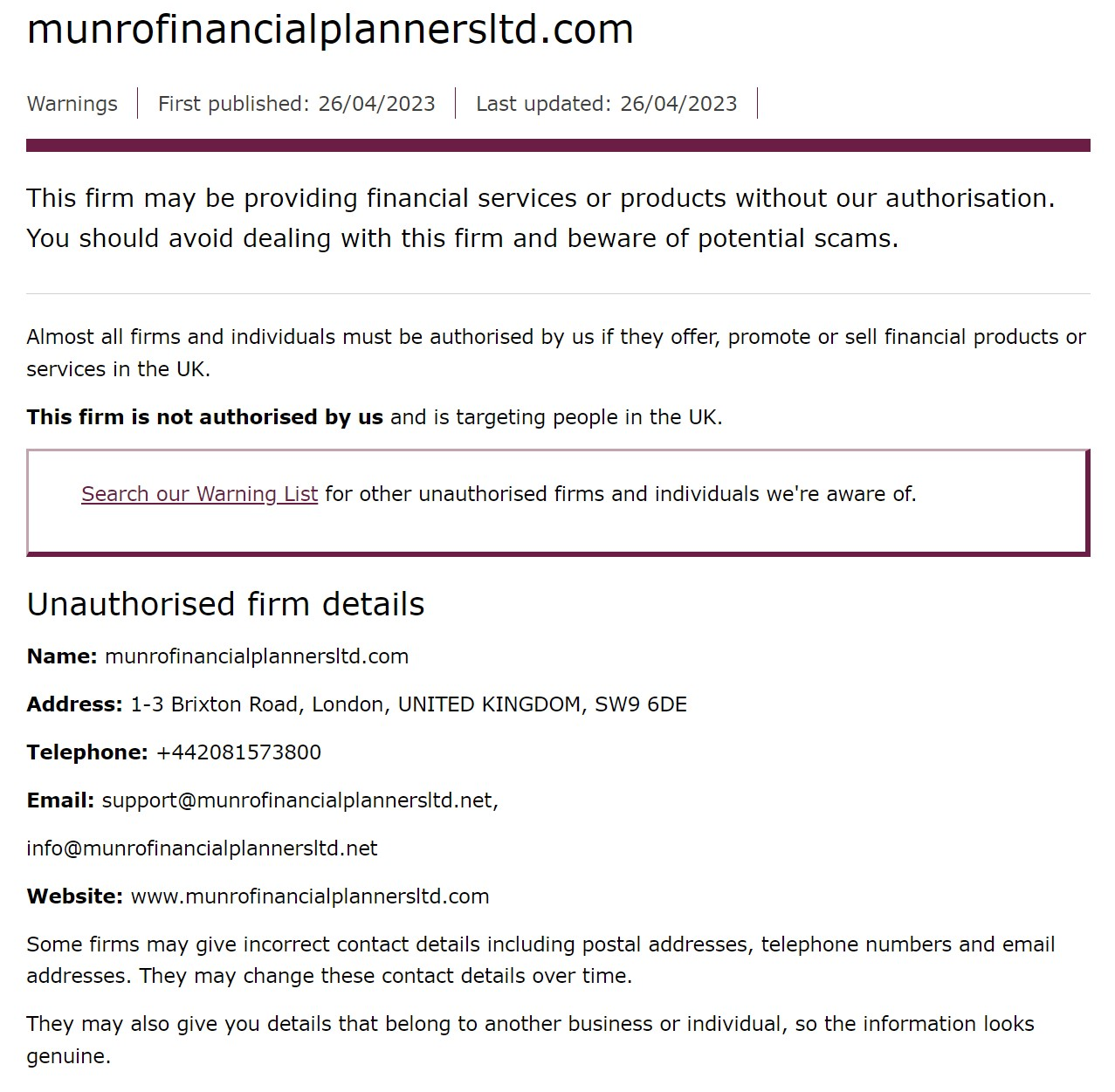

License and Regulations

The most crucial red flag: Munro Financial Planners Limited is not regulated by any reputable financial authority, including the Financial Conduct Authority (FCA) in the UK. This means they operate illegally and offer no investor protection.

Legal Warning Against Munro Financial Planners Limited

The FCA has issued a warning against Munro Financial Planners, explicitly stating that they may be providing financial services without authorization. This confirms their illegal operations and the risk of losing your invested funds.

Deposit and Withdrawal Methods

While they list debit/credit cards, bank transfers, and cryptocurrencies as deposit options, there is no information on withdrawal terms, fees, or processes. Reviews suggest that withdrawing funds from Munro Financial Planners is nearly impossible, further solidifying the scam claim.

Munro Financial Planners Limited Pros and Cons

Pros | Cons |

None | Unregulated and illegal operation |

No transparency and a lack of information | |

No demo account and limited platform access | |

High risk of losing your funds | |

Potentially impossible withdrawals |

Why Dealing With An Unlicensed Broker Is Risky

Dealing with an unlicensed broker like Munro Financial Planners carries significant risks, including:

- Loss of funds: With no legal recourse, you have no way to recover your money if things go wrong.

- Unfair trading practices: Unregulated brokers can manipulate the platform to your disadvantage.

- Lack of security: Your personal and financial information may not be protected.

- No investor protection schemes: You are ineligible for compensation if the broker goes bankrupt.

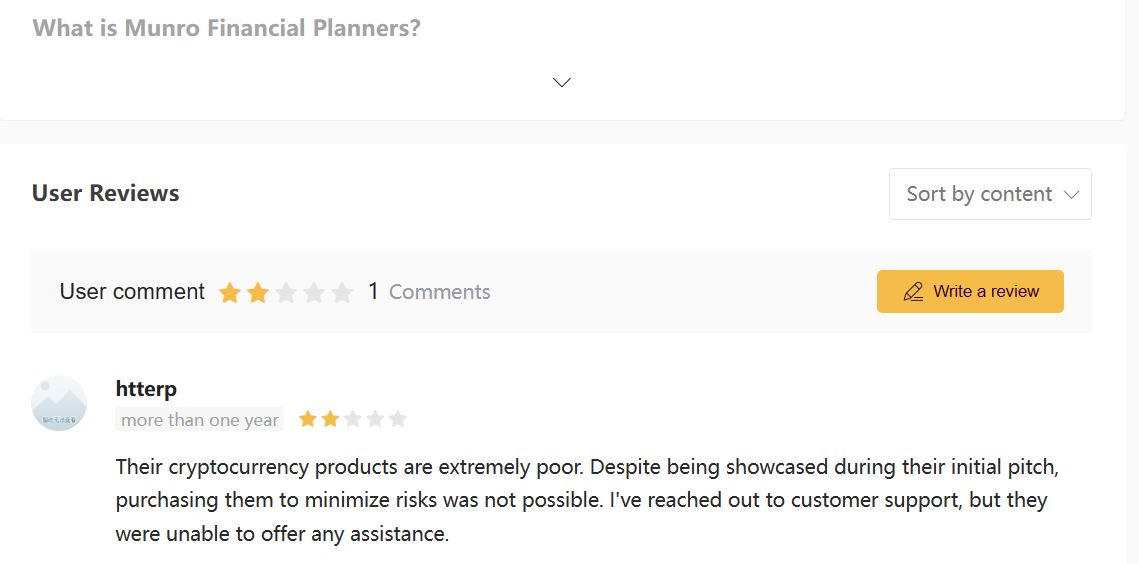

Client Feedback

Reviews from past clients indicate difficulties in withdrawing funds and suggest the broker may engage in manipulative practices. These negative experiences further solidify the fraudulent nature of their operation.

How Can “ReviewsAdvice” Help You If You Get Scammed?

Unfortunately, recovering funds lost to a scam broker is complex and challenging. However, seeking legal assistance and contacting relevant authorities may be helpful.

ReviewsAdvice can help you by providing free consultation and recovery service recommendations to help you in recovering the lost funds.

We will provide you recovery service recommendations, which will help you in recovering the lost funds or you can report to us today by the below form.

Get Your Money Back from Scammers.

Final Thought

Munro Financial Planners Limited is a clear example of a fraudulent operation. Their lack of regulation, negative reviews, and deceptive practices make them a significant risk to any potential investor. It is crucial to avoid any interaction with them and always choose reputable, licensed brokers to ensure your trading safety and financial security. Remember, if something seems too good to be true, it probably is.