In recent years, the financial market has seen an increase in the number of fraudulent brokers who prey on unsuspecting traders. One such broker is 360trader, which claims to provide excellent trading services to its clients. However, there have been several complaints about the broker’s unethical practices. In this article, we will review 360trader’s services, license status, legal warnings, and client feedback to help you make an informed decision when choosing a broker.

Company Overview

| Broker Name | 360trader |

| Website | 360Traders.co |

| Location | No contact location was found on the website |

| Regulation | Not regulated |

| Warnings | Multiples |

Team

There is no information about the team behind 360trader on its website, which is a red flag. A reputable broker should provide information about its management team, including their names and qualifications, to build trust with its clients.

Services or Products

360trader does not provide any detail on its service or products. The broker claims to offer competitive spreads, leverage of up to 1:400, and access to various trading tools and educational resources to help traders make informed trading decisions.

Trading Platforms

There is no clear information about its trading platform on its website. We also tried to find information about their platform and other social media, but there is also no information.

License and Regulations

License Status

360trader is not regulated by any reputable financial authority, which is a major cause for concern. The broker claims to be registered with the Financial Services Authority (FSA) of St. Vincent and the Grenadines, but this does not mean that it is licensed to provide financial services. The FSA is known for its lax regulations, and many fraudulent brokers use it to claim legitimacy.

Regulation Status

The lack of regulation means that 360trader can operate with impunity, and there is no guarantee that it will treat its clients fairly. 360trader does not provide any regulation information about their regulation. There are some warnings against them that will be discussed in the later section.

Why Dealing With Unlicensed Brokers Is Risky?

Dealing with unlicensed brokers like 360trader is risky because they operate outside the law, and there is no legal recourse if something goes wrong. Unlicensed brokers are not held accountable for their actions, and they can engage in unethical practices such as manipulating prices, freezing client accounts, or refusing to process withdrawals.

You also can go through our other scammer lists such as the SEC Blacklisted Companies, FCA Unauthorised Firms List, ASIC Blacklisted Companies, & Bank Guarantee/SBLC Review.

Legal Warnings Against 360trader

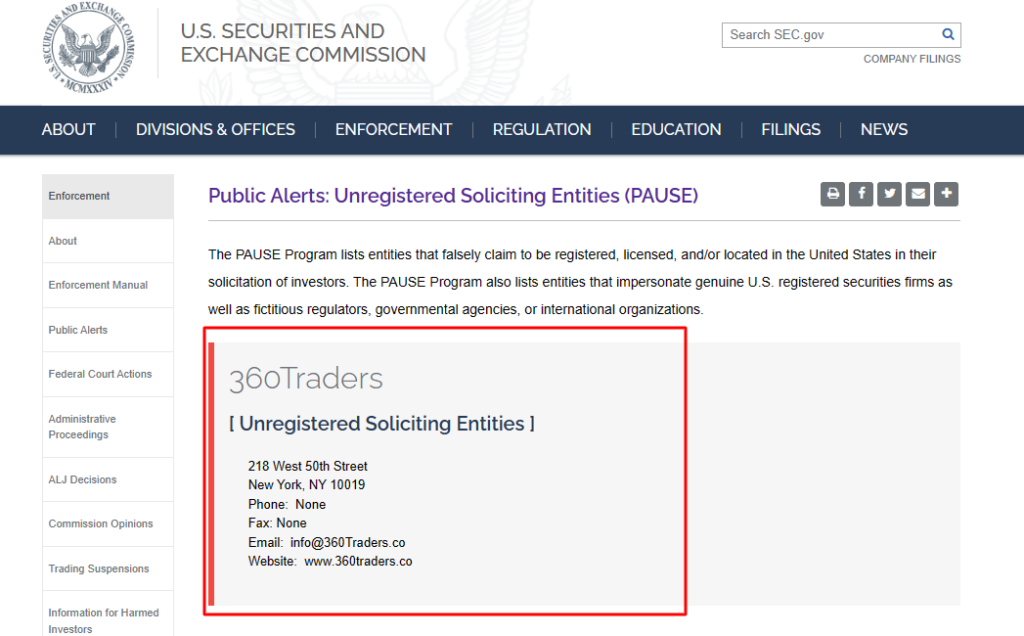

U.S. Security and Exchange Commission issued a warning against this broker mentioning that this is an unregistered entity to perform.

Client Feedback About 360trader

About Trading

Many clients have reported losing their funds while trading with 360trader. Some clients have reported that the broker manipulated prices to trigger stop-loss orders, causing them to lose their entire account balances. Other clients have reported that the broker used high-pressure sales tactics to convince them to deposit more funds, only to lose them all.

About Customer Service

Several clients have also reported poor customer service from 360trader. Clients have reported that the broker is difficult to contact, and when they do manage to get in touch, their issues are not resolved satisfactorily. Some clients have reported that the broker’s customer service representatives are rude and unprofessional.

How Can Reviewsadvice Help You If You Get Scammed?

If you have been scammed by 360trader or any other fraudulent broker, you can seek help from Reviewsadvise. After you submit your case to us, you will get a free consultation and service recommendations to help you recover the money.

Final Thought

Based on our analysis, we recommend that traders avoid 360trader and any other unlicensed broker. Dealing with unlicensed brokers is risky, and your funds are not guaranteed to be safe. It is important to do your due diligence when choosing a broker and ensure that they are licensed and regulated by a reputable financial authority. Doing so can protect yourself from falling victim to fraudulent brokers and ensure that your trading experience is safe and secure.